What are US Stocks?

US stocks are traded on major exchanges like NASDAQ and NYSE, with indices measuring market performance. US brokerage services are provided by SEC-registered stockbroker dealers. Disputes regarding these services cannot be resolved through Indian exchange investor redressal forums or arbitration mechanisms.

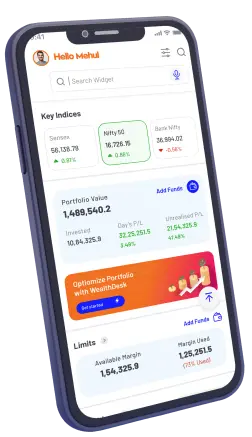

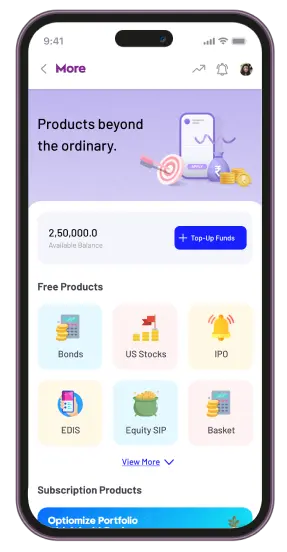

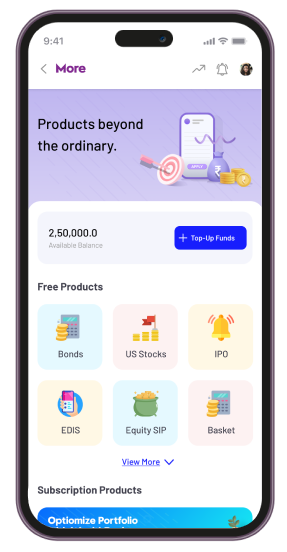

US stocks are tracked by three major indices: the Dow Jones Industrial Average, the S&P 500, and the NASDAQ Composite. The Dow follows 30 large blue-chip companies, the S&P 500 tracks 500 large companies from various sectors, and the NASDAQ Composite represents the value of stocks listed on NASDAQ. This is similar to the SENSEX and NIFTY in India. You can invest in US stocks using the BlinkX trading platform.

Click to know all about US Stocks

Types of US Stocks

Taxation

Mega Cap

The Mega-cap stocks refer to as one of the largest companies in terms of market cap. Usually, mega-cap companies have a market cap of above 200 billion dollars.

Large Cap Stocks

These are stocks of large, well-established companies. Large-cap stocks typically have a market capitalization of over $10 billion. Examples include Apple, Microsoft, and Amazon.

Mid-Cap Stocks

Mid-cap stocks are the stocks of companies with a market capitalization between $2 billion and $10 billion. Examples include Starbucks, Adobe, and PayPal.

Small Cap Stocks

Small caps are stocks referred to companies whose market cap is between $300 million and $2 billion. These are stocks of smaller, faster-growing companies. Examples include Roku, Etsy, Five Below

Micro Cap Stocks

Microcaps have a market cap below $300 million. These are stocks of very small, emerging companies. Examples include fuel cell companies like Plug Power.

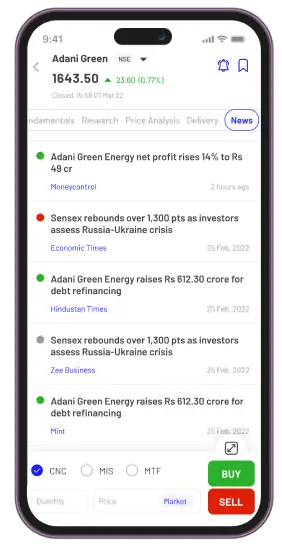

Indian investors should be aware about tax implications on US Stocks, such as the dividends and profits which are subjected to Indian tax regulations.

DTAA Treaty: Your investments are subject to a 25% flat tax in the US but here is the catch in order to avoid double taxation (DTAA) signed between both countries; you can use it to compensate for Indian taxes

You should know that any dividends or profits obtained from these investments are subject to taxation according to Indian tax regulations. Here is an overview of all you need to know.

Short-term Capital Gain Tax: When you have stocks for less than a year, you'll need to pay Short-term capital gains tax (STCG). Depending upon your gains, taxes are added on the basis of your income tax slab.

Long-term Capital Gain Tax: When you hold stocks for more than two years, you'll be paying long-term capital gains Tax (LTCG). Here you will need to pay 20% tax on your capital gains.

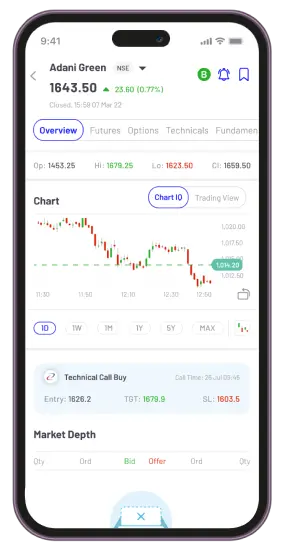

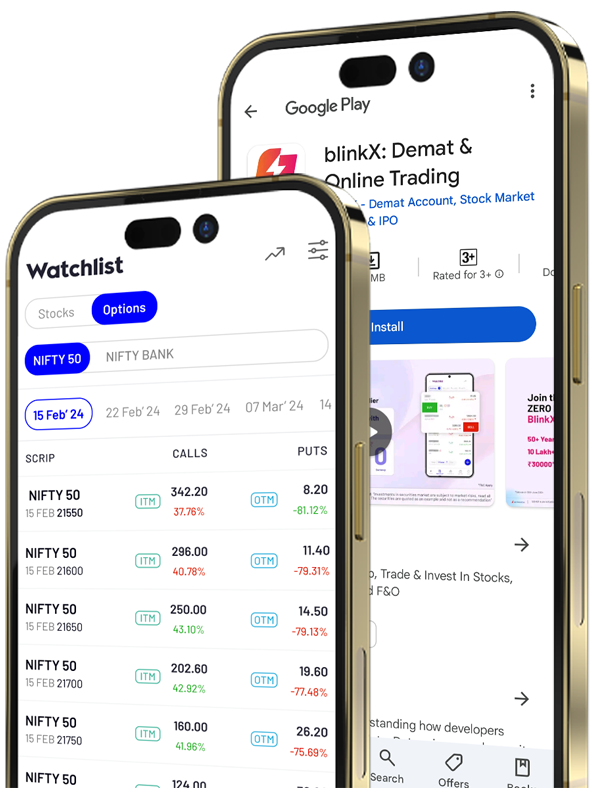

Americano, your way to wealth creation

Say no to complexities

Beautiful minds at work

Think big buy small