What are the Documents Required for Demat Account?

- ▶<span lang="EN-US" dir="ltr"><strong>List of Documents Required to Open Demat Account</strong></span><strong> </strong>

- ▶<span lang="EN-US" dir="ltr"><strong>Conclusion</strong></span><strong> </strong>

To open a Demat account, investors must provide all the important documents such as identity proof, address proof, PAN card, bank account details, and a recent passport-size photograph. These documents for Demat account are necessary to verify the investor’s identity and ensure secure access to their electronic holdings. Demat accounts make trading safer, quicker, and more convenient by allowing investors to hold shares and other securities digitally. The process follows all SEBI rules, ensuring clear, convenient, and compliant investing for all investors. This article explains what are the documents required for Demat account opening.

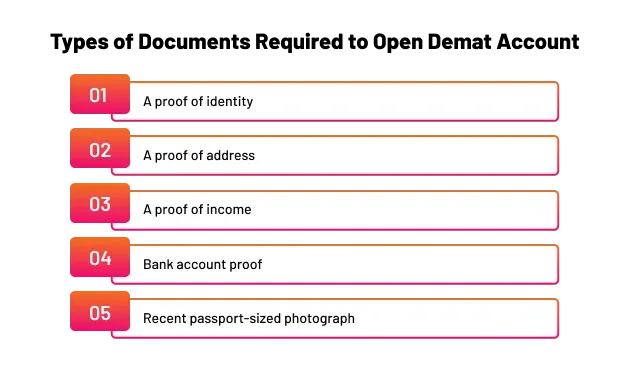

List of Documents Required to Open Demat Account

The following is a list of documents required for opening Demat account.

1. Identity Proof

- PAN Card (mandatory)

- Aadhaar Card

- Voter ID

- Passport

- Driving Licence

2. Address Proof

- Aadhaar Card

- Passport

- Voter ID

- Driving Licence

- Utility Bills (Electricity, Water, Gas, these bills should be not older than 3 months)

- Bank Statement or Passbook (recent)

3. Income Proof (Required only for trading in Derivatives – F&O / Commodities / Currency)

- Latest Salary Slip

- Income Tax Return (ITR Acknowledgment)

- Form 16

- Bank Statement (last 6 months)

- Net Worth Certificate issued by a CA

4. Bank Proof

- Cancelled Cheque (with name printed)

- Bank Passbook (first page)

- Bank Statement (recent)

5. Passport-Size Photographs

- Recent colour photographs

- As per the size and format required by the broker/DP

6. Signature

- Sample signature of investor is required for KYC verification

- Should match the signature on PAN card

Conclusion

Conclusion

Investing in financial markets and holding securities electronically requires opening a Demat account. A complete set of are required for a successful application for a Demat account, including proof of identity, address proof, income proof, and proof of bank account. Applicants must submit their PAN card as a fundamental requirement, along with other identification documents from government authorities or financial institutions. The online trading app can assist you with opening a Demat account and simplifying your investment journey, creating a seamless and efficient experience.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

FAQs on Document required for opening Demat account

How much money do I need to open Demat account?

Your choice of DP will determine the minimum amount you need to open a demat account. According to your DP, the minimum amount ranges from 0 to 500 rupees. Additionally, many DPs offer free Demat accounts without any opening fees.

Can I open a Demat in any bank?

In any bank branch, you can open a Demat account.

Can I hold 2 Demat accounts?

There is no limit to how many Demat accounts you can have.

What are the benefits of a Demat account?

Holding shares and securities through a Demat account is convenient and digitally secure. This prevents theft, forgery, loss, and damage of physical certificates. Using a Demat account, investors can instantly transfer securities. As soon as the trade is approved, the shares are digitally transferred to Demat account.

Is it possible to open a Demat account online?

Yes, stockbrokers and depository participants (DPs) make it simple for investors to open a Demat account online. This straightforward procedure involves uploading Aadhaar-based verification and digital KYC.