Link Aadhaar Number With Demat Account

- ▶<strong> </strong>Documents Required to Link Aadhaar with Demat account

- ▶How to Link Aadhaar with Demat account online?

- ▶Before Starting the Online Linking Process, What Should You Check

- ▶How to Verify that the Aadhaar and Demat Account Linking Process was Successful?

- ▶Benefits to Link Aadhaar with Demat Account

If you want to invest in stocks, you must take specific legal precautions. The first step is to link Aadhaar to the Demat account you have. All brokers/brokerage businesses are required by the market regulator Securities Exchange Board of India (SEBI) to link Aadhaar with Demat accounts of investors utilising their trading platforms.

The National Securities Depositories Ltd (NSDL) then offered the ability for any investor to link their Aadhaar to their online Demat account.

Online linking is a simple method that doesn't involve a lot of paperwork. Aadhaar identification and a Demat account are important because:

The Unique Identification Authority of India (UIDAI), a union government agency, issues 12-digit personal identification numbers known as Aadhaar, which are used as identification and address evidence throughout the nation.

A Demat account is a dematerialized account where the actual shares are stored electronically instead of in the physical form. Without a Demat account, it is impossible to trade stocks.

Documents Required to Link Aadhaar with Demat account

Following are the documents that you will need to Link aadhaar with Demat account.

- Pan Card

- Aadhaar card Number

- Demat account Number

- Client ID and depository participant’s ID

- Your registered mobile number

How to Link Aadhaar with Demat account online?

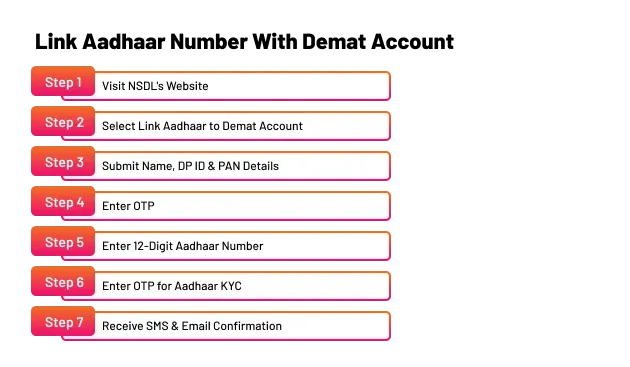

Linking your Aadhaar with your Demat account online is a straightforward process. Following are the steps involved in linking aadhaar with Demat account.

Step 1: Go to the official NSDL website.

Step 2: Select the option "Click here to link Aadhaar Number to Demat account" on the webpage.

Step 3: Provide your Depository Participant's name, DP ID, client ID, and PAN details.

Step 4: Receive an OTP on your registered mobile number and email ID.

Step 5: Enter the OTP and click on the proceed button.

Step 6: Input your Aadhaar card details along with other necessary information and click proceed.

Step 7: Receive another OTP on your mobile number linked with Aadhaar.

Step 8: Enter the OTP and click Submit to complete the process.

Before Starting the Online Linking Process, What Should You Check

Before initiating the online linking process, it's crucial to conduct several essential checks to ensure a smooth and secure experience.

- Your Demat account name should align with the name on your Aadhaar card for successful UIDAI authentication.

- To verify your Aadhaar details during the linking process, ensure your mobile number and email address are linked with the depository.

- OTP-based verification requires your mobile number to be connected with your Aadhaar card.

- Before initiating the linking process, have essential details like DP Name, DP ID, PAN, etc. ready.

- For security reasons, refrain from linking your Aadhaar to your Demat account on shared or public computers or via public internet connections to avoid hacking or phishing attempts.

How to Verify that the Aadhaar and Demat Account Linking Process was Successful?

You can easily confirm the successful linkage of your Aadhaar with your Demat account by following these steps:

- Go to the UIDAI website.

- Select the option "Check Aadhaar Linked Account."

- Enter your 12-digit Aadhaar number.

- Receive an OTP on your mobile and input it in the designated field.

- View all accounts, including your Demat account, linked to your Aadhaar.

Benefits to Link Aadhaar with Demat Account

Connecting your Aadhaar with your digital Demat account offers numerous benefits, including:

- Integrating your Aadhaar with your Demat account simplifies the paperwork required for Futures and Options Trading.

- The hassle-free eKYC approval process validates all details using your Aadhaar card, ensuring a quick and easy verification process.

- Demat accounts lacking Aadhaar linkage might face potential deactivation, emphasising the importance of this connection.

- This linkage not only enables effortless supervision by regulators but also plays a crucial role in fraud prevention, enhancing overall security in trading activities.

Conclusion

In order to comply with the regulations of the securities market regulator, you must register a Demat account using your Demat account app and link it to your Aadhaar. To stop fraudulent activity in the securities market, this mechanism has been put in place. As a result, everyone wins when you link aadhaar to a Demat account. Aadhaar and other essential documents are mandatory for opening a Demat account.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

FAQS on Beneficiary Owner Identification

Is Aadhaar mandatory for Demat accounts?

Yes, all brokers/brokerage businesses are required by the market regulator Securities Exchange Board of India (SEBI) to link Aadhaar with the Demat Account of investors utilizing their trading platforms.

With an Aadhaar card, can we open a Demat account?

Yes, you may use your Aadhaar card to create a Demat account. The Aadhaar card is really required to conduct transactions in a Demat account in accordance with the rules established by SEBI.

How to link aadhaar with a demat account online?

To link Aadhaar to a demat account online, you must go to the NSDL's official website and complete a simple procedure.

How do I find out if my Aadhaar card and demat account are connected?

You might use a cross-checking procedure. To check your Aadhaar-linked account, visit the UIDAI website by clicking on it. To get an OTP, enter your Aadhaar number; once you've verified it, you may browse all of your Aadhaar-linked demat accounts.

If Aadhaar is not associated with a mobile number, how can I register a Demat account?

If your Aadhaar is not connected to your cell number, you can still create a Demat account by going to the DP's physical location.