Types of Demat Accounts: Meaning & Differences

- ▶Following are the types of Demat Accounts in India

- ▶Difference Between BSDA Account & Regular Demat Account

A Demat account is an important part of the stock market. Having a Demat account online or opening a Demat account from a reliable broker opens a door to opportunities to invest & diversify your financial portfolio.

Demat accounts, also known as dematerialized accounts, are accounts that lets you hold your securities and shares in digital form. It means instead of receiving physical certificates to hold your shares, they're stored in digital form through a depository participant (DP).

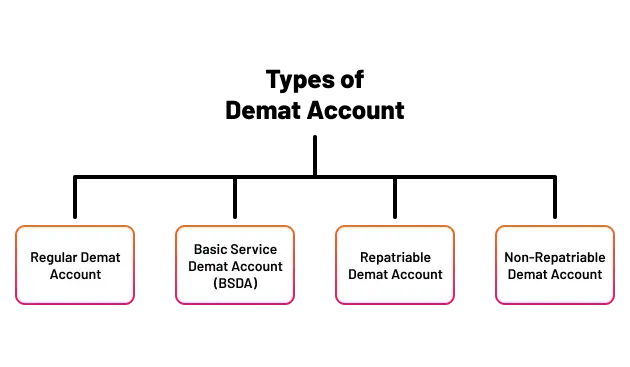

Following are the types of Demat Accounts in India

In India, there are four major types of Demat accounts, including regular Demat, BSDA Demat Account, a repatriable Demat account & a non-repatriable Demat account. You need to know about each Demat account & its functions to open your Demat account.

1. Regular Demat Account

For the majority of Demat account holders, this is the standard Demat account offered by brokers and depository participants. It allows the holding and transacting of securities in electronic form. There are no restrictions on transactions or holdings. Annual maintenance charges vary from broker to broker.

2. Basic Service Demat Account (BSDA)

This is a lower cost demat account with limited services. The holdings are capped at Rs 2 lakhs and transactions at a specified number per year. The AMC is lower compared to regular demat. Many discount brokers offer to open a BSDA account online.

3. Repatriable Demat Account

This account allows investors residing outside India to take part in the share market. It is held by NRIs, PIOs and foreign nationals wanting to invest in Indian securities while having the flexibility to open a repatriate account. In this account, the capital and profits earned back to their home country.

4. Non-Repatriable Demat Account

Particularly for Indians who are not residents, it is advised. One's wealth and assets cannot be moved between nationalities in this kind of online demat account. A non-repatriable demat account necessitates that your money be linked to a non-resident traditional bank account, just like a repatriable demat account does. To hold and buy/sell assets on the stock market, respectively, it's necessary to create a Demat account & a trading account.

However, there are a number of different accounts that you need to be aware of, like what is BO ID meaning, what a trading account is, what a demat account is, and the many other sorts of demat accounts along with different classes of accounts.

The requirement for a non-resident external bank account for these types of Demat accounts is one condition of getting a repatriable demat account.

Difference Between BSDA Account & Regular Demat Account

You can consider the major difference between the BSDA and a regular demat account is the maintenance charges. Here are the main differences of these two Demat account in the below table:

| Factors | BSDA Demat Account | Regular Demat account |

|---|---|---|

| Eligibility | Any individual, especially beginners in the stock market, can open a BSDA by following the conditions set by SEBI. | Regular Demat Any individual who wants to invest in the stock market |

| Limit of Holdings | An amount of Rs. 2 lakh or less is acceptable. | No limit in holdings |

| No limit in holdings | Limit as per the SEBI rules. | Unlimited Transaction on regular Demat Account |

| Brokerage Services | Mostly Discount broker services offer BSDA account | A full-service brokerage or discount brokerage both offer regular Demat account |

| Conversion | You can convert it to regular Demat account | Not applicable for the conversion of a Demat account. |

Conclusion

A Demat account is an electronic archive where digital assets like securities are stored, and it is necessary for trading. There are three different types of Demat accounts in India: regular, repatriable, and non-repatriable. A regular Demat account is the most common and suitable for equity share trading, while a BSDA is a type of regular account that does not charge maintenance fees for holdings below 50,000/-.

You can open a demat account with BlinkX. After opening a Demat account with BlinkX, you can take leverage of different tools & analytics charts on the trading app. Invest in different types of investment instruments with the help of BlinkX.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

FAQs on Types of Demat Account

Can you open multiple demat accounts?

Yes, you can open multiple demat accounts from different brokerage firms in India.

How many demat accounts can be linked to your PAN card?

You can open multiple demat accounts and link them with your PAN card. There is no limit to the number of demat accounts you can link with your PAN card.

State the difference between demat and trading account?

The Difference between demat and trading account is the function they do, trading account is used to transfer funds, whereas in your demat account you can safely store all your financial assets.

Is it compulsory to add a nomination to your demat account?

According to Securities and Exchange of India(SEBI) has made it mandatory to add a nominee name & details for your demat account.

Can NRIs open demat accounts in India?

Yes, NRIs (Non-Resident Indians) can open demat accounts in India. They can choose between a Repatriable Demat account and a Non-Repatriable Demat account.