What are the Annual Maintenance Charges for a Demat Account

- ▶Types of Annual maintenance charges

- ▶Different Types of Demat Account Charges

- ▶Who Levies Annual Maintenance Charges?

- ▶Factors that Affect Annual Maintenance Charges

Annual Maintenance Charges also known as (Account Maintenance Charges) is a fee charged to an investor for keeping their financial holdings in digital format with the depository. These charges depend on different stock brokers. You can explore details about Demat Account Maintenance Charges in the following article.

Types of Annual maintenance charges

There are different types of Annual maintenance charges depending upon the Demat account some of them are as follows:

- Regular Demat account

- Partnership firms, HUF & Individuals Demat account

- NRIs Demat Account

- Corporates like LLPs along with private & public firms Demat account

AMC, other charges for each Demat account varies, depending upon the broker to broker charges can be different. To invest in the Indian stock market, investors need to open a Demat account. The function of a Demat account is to keep all your financial holdings safe & sound. As with any other digital account, different types of charges are attached to your Demat account. Let's discuss some of the essential charges of your Demat account.

Different Types of Demat Account Charges

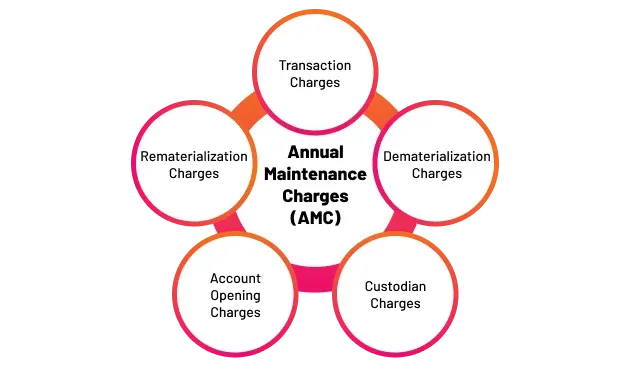

Know about several types of AMC charges in Demat accounts that investors may encounter when trading in the Indian stock market. Some of the common charges include:

Who Levies Annual Maintenance Charges?

As mentioned earlier, Annual maintenance charges in the Indian stock market are typically levied by the depository participant (DP) or the stockbroker with whom the investor has opened their trading and Demat account.

These charges may vary depending on the DP or broker and the type of account the investor has opted for. Some common types of AMC charges in the Indian stock market include annual maintenance charges, transaction charges, custodian charges, and Demat charges.

It is important for investors to carefully read and understand the fee structure and terms and conditions before opening a Demat account with any DP or broker in India.

Factors that Affect Annual Maintenance Charges

Various factors can affect the Annual maintenance charges for Demat accounts. Some of them are as follows:

- Holding value: Accounts with higher portfolio values often have higher maintenance fees. Charges may be correlative, i.e. percentage of the holding value.

- Transaction activity: Accounts with more buy/sell transactions may be charged higher fees. Charges may be fixed per transaction.

- Delivery type: Charges may be higher for accounts with more deliveries based on transactions and their types.

- Value-added services: Depending upon your broker, a discount broker or full-service broker, Each broker has different charges. The availability of additional services from full-time brokerages, like research reports, margin funding, SIP/STP facilities, etc., may increase charges.

Investors need to understand the different types of AMC charges levied by their DP or broker before opening a trading and Demat account. They should compare the charges across various service providers and choose the one that offers the best value for money.

Yes, there are consequences for failing to pay the Annual maintenance fees. These consequences can include account deactivation and broker legal action. To avoid any hassles, it's crucial to pay your fees on schedule.

Conclusion

Financial institutions levy Annual maintenance charges to offset the expenses of monitoring and servicing customer accounts. Savings accounts, current accounts, Demat accounts, and other sorts of accounts are all subject to these fees. These fees are there to make sure the financial institution can maintain the required systems, offer client service, and handle account management-related administrative duties. BlinkX provides intuitive tools and educated insight to trade in the stock market. Download the BlinkX trading app to trade in a hassle-free environment.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

Frequently Asked Questions on Annual Maintenance Charges

What are AMC Demat account charges?

Depository Participants (DPs) or Brokerage houses charge minimal annual fees for their services. This fee is called AMC for Demat Account Charges.

Is there any maintenance charge for a Demat account?

Yes. For demat accounts, there are maintenance charges called Account Maintenance Charges. Typically, these fees range from Rs 300 to 900 per year.

If I do not pay the AMC for my Demat account, what happens?

If you don't pay AMC for a demat account, your account will become dormant (inactive). Until you reactivate your account, you won't be able to perform any transactions.

Can I get a free Demat account?

Yes. There are some DPs that do not charge the first year's AMC Demat fee for new customers.

Are AMC charges monthly or yearly?

The AMC for the demat account is charged on yearly basis.