Mandatory Attributes of KYC for Demat Account

- ▶What is the Online KYC for a Demat Account?

- ▶Six Attributes of KYC for Demat Account

- ▶Why are these KYC Attributes Important?

You may already be aware that if you want to invest in the stock market, you need a Demat account. Additionally, whether you open a Demat account online or offline, a broker will ask you to go through a process known as Know Your Customer (KYC). KYC for the Demat account is a mandatory process. This article will explain the online process of KYC for Demat account holders.

What is the Online KYC for a Demat Account?

KYC is the online process of confirming a customer's identity to make sure they are a real applicant and not engaged in any unlawful activity, such as money laundering or financing terrorism. To ensure that the securities market stays open and free from fraud, SEBI (Securities and Exchange Board of India) has set specific KYC requirements for Demat account holders.

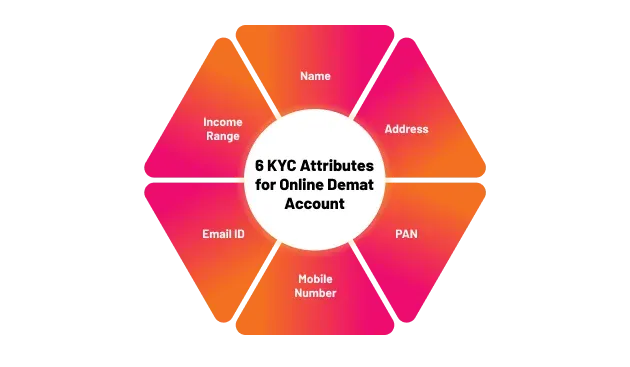

Six Attributes of KYC for Demat Account

To initiate trading, ensure your KYC Demat account process is up to date and compliant with regulatory requirements. SEBI has mandated six KYC details that investors must submit while opening a Demat account. Let us take a look at those six KYC attributes:

1. Name: Your name is the very first KYC attribute you provide when you open a Demat account. It helps in identifying the individual or entity associated with the Demat account. The name provided should match the official identification documents, such as PAN, Aadhaar card, passport, or driver's licence. Generally, your name is already entered in since you have provided it earlier to your broker. However, if it is not the same as it is in your official documents, make the necessary changes.

2. Address: The next crucial KYC attribute is your residential address; it helps in verifying the identity and establishing the contact details of the account holder. You will have to submit an address proof document, which could be any document that attests to the account holder's present address. They include documents like utility bills, bank statements, or rental agreements.

3. PAN: Today, SEBI has made it mandatory for all Demat account holders to link their Demat accounts with their PAN cards. That is because the PAN helps in tracking financial transactions and preventing tax evasion. The Income Tax department only considers your PAN to identify your trades in the financial markets.

4. Mobile Number: Nowadays, almost everything you sign up for asks for your mobile; even the cashier at your local supermarket may ask for it. Likewise, your mobile account is also an essential KYC attribute for a Demat account—enabling smooth communication between the account holder and the depository participant. The depository participant will send you notifications regarding your trades, price alerts, updates, and other important information related to your Demat account.

5. Email ID: Similar to a mobile number, your email ID is another thing required for signing up for various things, including a Demat account. Hence, an active email ID is another KYC attribute required for communication purposes. You will receive electronic statements, contract notes, and other notifications related to your Demat account through the provided email ID.

6. Income Range: KYC Demat account procedures are essential for all investors. The last KYC detail you provide is your income range. This is especially important if you wish to trade in the derivatives segment.

Why are these KYC Attributes Important?

- The required KYC characteristics for Demat account holders are significant for a number of reasons. First and foremost, they aid in preventing dishonest practices like money laundering & financing of terrorism. SEBI can make sure that there are no unlawful activities taking place in the securities market by confirming the account holder's identification and address.

- Second, KYC characteristics aid in preventing theft or unauthorised access to the account holder's securities. SEBI can make sure that only the approved individual has access to the securities housed in the Demat account by validating the account holder's identification and address.

- Third, KYC characteristics assist in guarding against identity theft. SEBI can prevent anyone else from opening a Demat account in the account holder's name by confirming the account holder's identity and address.

Conclusion

KYC for Demat account is a crucial step for opening a Demat account. To preserve the security & transparency of the stock market, Demat account holders in India are required to meet certain KYC requirements either online by using the Demat account app or offline. Before opening a Demat account, SEBI-registered intermediaries must confirm the account holder's identity and address. To ensure a hassle-free experience when opening a Demat account, make sure to provide the SEBI-authorised intermediary, your stockbroker, with all the necessary KYC criteria.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

FAQS on KYC for Demat Account Holders

Is it possible to open an online Demat account without submitting KYC documents?

No, you cannot open a demat account without delivering the required KYC paperwork. To preserve the security and transparency of the securities market, SEBI has made it necessary for all Demat account holders to provide their KYC documents.

Can I submit my Aadhaar card instead of my PAN for the online Demat account KYC?

No, SEBI has made it mandatory to submit your PAN card details for your online demat account KYC.

Can I use the same KYC documents for multiple Demat accounts?

Yes, the same KYC documents may be used for a variety of Demat accounts. The KYC documents must be provided to each middleman separately, though.

What is the penalty for not complying with the mandatory online KYC requirements for Demat accounts?

The online KYC standards for Demat accounts are mandatory, although SEBI has not outlined any penalties for not meeting them. The Demat account may, however, be blocked or cancelled if KYC standards are not met.

Can I submit online copies of my KYC documents for opening a Demat account?

Yes, nowadays electronic or online copies of KYC documents are generally submitted to open a Demat account.