What are Option Greeks?

- ▶<span lang="EN-US" dir="ltr"><strong>Types of Option Greeks Explained</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Importance of Option Greek for Traders</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Role of Option Greeks</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Limitations of Option Greeks</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Conclusion</strong></span>

Option Greeks generally refer to risk-sensitivity measures that help explain how an option’s price may react to changes in different market factors such as the underlying asset’s price, time to expiry, volatility, and interest rates. These metrics are often used to interpret how options behave under varying market conditions rather than predicting outcomes. In this article individuals can explore option greeks explained in detail, along with their types, formulas, practical interpretation, limitations, and more.

Types of Option Greeks Explained

Now since what is option Greek is clear, let's understand its types. Below are the major types of option greeks, along with their formula representation and what each measure may indicate for traders in a practical sense.

Delta

Delta (Δ) generally measures how much an option’s price may change in response to a small change in the price of the underlying asset.

Formula:

Δ= ∂V/AS

Where:

∂ = First Derivative

V = Option price

S = Price of the underlying asset

Delta is typically expressed as a value between −1 and 1. Call options usually have positive delta, while put options usually reflect negative delta.

If a call option has a delta of 0.5, it suggests that for a small rise in the asset price, and the option’s value may change proportionately by half of that movement.

Gamma

Gamma (Γ) generally measures how much Delta itself may change when the underlying asset price moves. Gamma is usually higher when an option is at-the-money and tends to decline when it becomes deep in-the-money or out-of-the-money.

Formula:

Γ= ∂Δ/∂S = ∂2V/∂2S

A higher Gamma may indicate that Delta can change quickly, which means the option position may require closer monitoring or more frequent adjustments.

Vega

Vega (ν) generally measures the sensitivity of an option’s price to changes in the volatility of the underlying asset. Vega is often expressed as the possible price change for a 1% change in volatility.

Formula:

ν = ∂ν/∂σ

Where:

∂ = first derivative

V = option’s price

σ = volatility of the underlying asset

If Vega is high, the option price may be more influenced by changes in market volatility rather than only price movements.

Theta

Theta (θ) generally reflects how an option’s price may change as time passes and expiry approaches. Theta is often referred to as time decay and is usually negative for most options, meaning the option’s value may reduce gradually as expiry nears.

Formula:

θ = - ∂V/∂t

Where:

∂ = first derivative

V = option’s price

t = option’s time to maturity

A high negative Theta may suggest that holding an option for longer durations could gradually reduce its value with time.

Rho

Rho (ρ) generally measures how an option’s price may react to changes in interest rates. Call options usually have positive Rho, while put options generally reflect negative Rho.

Formula:

ρ = ∂V/∂r

Where:

∂ = first derivative

V = option’s price

r = interest rate

Rho may be more relevant in scenarios where interest rate movements are significant or when options have a longer time to expiry.

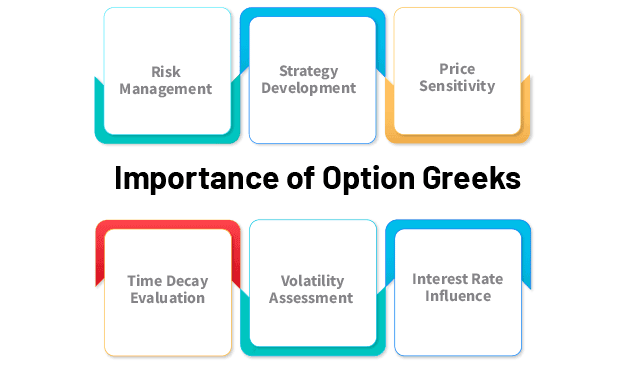

Importance of Option Greek for Traders

Option chain Greeks are indispensable tools for options traders, providing a systematic and quantitative framework for risk assessment, strategy development, and dynamic decision-making in the complex derivatives market.

1. Risk Management

Option Greeks are essential for assessing and managing risks associated with options trading. They provide a quantitative measure of how sensitive an option's price is to changes in various factors, helping traders identify and mitigate potential risks.

2. Strategy Development

Understanding Option Greeks enables traders to develop more sophisticated and effective trading strategies. By analysing Delta, Gamma, Theta, Vega, and Rho, traders can tailor their approaches to market conditions and their risk tolerance.

3. Price Sensitivity

Delta, the measure of an option's price sensitivity to changes in the underlying asset's price, is crucial for predicting and managing directional risk. It helps traders assess how much an option's value will change for a one-point move in the underlying.

4. Time Decay Evaluation

Theta measures the influence of time decay on the value of an option. Traders use Theta to optimise entry and exit points, considering how the option's value erodes as it approaches expiration. This is crucial for managing time-sensitive strategies like options selling.

5. Volatility Assessment

Vega measures how responsive an option is to shifts in implied volatility. Traders rely on Vega to gauge the impact of market volatility on option prices, helping them make informed decisions on when to enter or exit positions.

6. Interest Rate Influence

Rho indicates how an option's price reacts to changes in interest rates. This is particularly relevant in assessing the impact of macroeconomic factors on options, allowing traders to adjust their strategies based on anticipated interest rate movements.

Role of Option Greeks

By understanding the meaning of what is Greek in options it's clear that options Greeks serve as indispensable tools for options traders, providing a systematic and quantitative approach to risk assessment, strategy development and dynamic decision-making in the complex derivatives market.

1. Portfolio Management

Option Greeks provide a quantitative framework for portfolio managers to analyse and manage risks associated with options positions. By considering these metrics collectively, portfolio managers can optimise the risk-return profile of the entire portfolio. Option Greeks measure how time affects investments, helping traders choose the best times to enter or exit trades by considering the impact of time passing.

2. Customisation of Strategies

Delta, Gamma, Theta, and Vega collectively provide a toolkit for tailoring trading strategies to specific market conditions and risk preferences. Remember that customisation should align with your overall trading or investment goals, risk appetite, and market expectations.

3. Price Sensitivity Analysis

Option Greeks are crucial tools for conducting price sensitivity analysis, providing insights into how option prices are expected to change in response to various movements in the underlying asset. Delta helps traders predict and understand how an option's price will move in response to underlying asset price changes.

4. Dynamic Hedging

Dynamic hedging is often implemented to offset or minimise exposure to options Greeks, especially Delta and Gamma. The goal is to maintain a neutral or desired risk profile and protect the portfolio from adverse price movements. Gamma's role in dynamic hedging is critical, enabling traders to adapt their hedges as the underlying asset's price fluctuates, ensuring effective risk management.

5. Time Decay Management

Managing time decay, also known as Theta, is a crucial aspect of options trading. Time decay represents the reduction in the value of an option as time passes, particularly as it approaches its expiration date. Theta is essential for managing the impact of time decay on option premiums and guiding decisions on when to enter or exit positions.

Limitations of Option Greeks

A suitable way to understand Greeks options is to recognise that, while they provide useful sensitivity measures, they may also have certain limitations:

- They may rely on assumptions and estimates that require reasonably accurate market forecasts.

- They may be less suitable in cases where price behaviour is highly uncertain or inconsistent.

- They may not fully reflect factors such as sudden market events or behavioural influences.

- They may offer limited insight where underlying earnings or financial performance remain volatile.

- They may not completely account for capital structure differences or valuations based on intangible factors.

Disclaimer: All investments are subject to market risks, economic conditions, regulatory changes, and other external factors. Returns are not guaranteed and may vary based on market performance and investment tenure. Investors should assess their risk tolerance and financial objectives, conduct their own research, and consult a qualified financial advisor before making any investment decisions.

Conclusion

Option Greeks generally help explain how an option’s price may respond to movements in price, volatility, time, and interest rates. They are often used to understand risk sensitivity and interpret option behaviour in different market situations. Traders may review concepts such as Delta, Gamma, Vega, Theta, and Rho to assess price reactions and time or volatility effects. Today, learners may explore these concepts through a stock market trading app, where educational resources and market insights are available.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

FAQs on What are Option Greeks

What is the formula for Option Greeks?

The formula for Option Greeks varies for each Greek and is used to assess risk and price sensitivity.

What is alpha beta gamma in options?

Alpha, beta, and gamma in options refer to sensitivity to price changes, overall market movements, and the rate of change in Delta.

What does gamma Greek mean in options?

Gamma Greek in options signifies the rate of change in an option's Delta in response to changes in the underlying asset's price.

How many Option Greeks are there?

There are five primary Option Greeks: Delta, Gamma, Theta, Vega, and Rho, each providing insights into different aspects of options pricing and risk.

What is the role of Vega in Option Greeks?

Vega measures an option's sensitivity to changes in implied volatility, offering insights into how volatility fluctuations affect option prices.