Single Candlestick Patterns

- ▶What are Single Candlestick Patterns?

- ▶What do Single Candlestick Patterns Indicate?

- ▶Top 10 Single Candlestick Patterns

- ▶Advantages and Disadvantages of Single Candlestick Patterns

Single candlestick patterns are useful for predicting the future, analysing historical data, and gauging market trends. They are technical indicators in their most powerful form. Candlesticks may be used as historical indicators since they are constructed based on previous market activity. However, the candlesticks formed are very helpful in predicting future trends and price patterns.

What are Single Candlestick Patterns?

Single candlestick patterns are trend reversal patterns, and they should be read within the context of preceding candlesticks and require confirmation. These patterns should appear in an established trend and should be ignored in non-trending markets. When trading, the length of the candle is crucial, as it signifies the day's range and the intensity of buying and selling activity. Short candles indicate subdued trading, and trades must be qualified based on the length of the candles. Avoid trading with muted short candles.

What do Single Candlestick Patterns Indicate?

- Single candlesticks reflect the psychology of bullish and bearish forces during a trading session.

- Longer real bodies signify intense momentum, while small bodies represent indecision and consolidation.

- The colour of the real body conveys critical information, with green or white candles indicating buying win and red or black candles indicating bearish forces prevailed.

- Long green or white candles show strong buying pressure and upside momentum, while long red or black candles signal intense selling pressure.

- Short candles indicate a period of consolidation and indecision between buyers and sellers.

- Marubozu candles without wicks demonstrate complete control by buyers or sellers from beginning to end.

- Spinning tops form when the candle has tiny real bodies and long upper/lower wicks, signalling potential exhaustion and trend reversals.

- Doji candles, with equal opening and closing and almost no real body, indicate complete indecision as neither buyers nor sellers could gain control.

- Interpreting single candlesticks in conjunction with other technical analysis tools improves the chances of accurately forecasting future price direction.

Top 10 Single Candlestick Patterns

Single candlestick patterns come in a variety of forms and offer trading advice and signals. Below are 10 important single candlestick patterns.

Shooting Star Pattern

Shooting star candlestick pattern overview:

Meaning: Waiving upside momentum, weakening demand, and building bearish momentum in the uptrend.

Body: Small, located near the bottom of the candlestick's range.

Wick: Long upper wick above the body, indicating higher prices but close near the bottom.

Location: In an uptrend, indicating potential topping behaviour and future weakness.

Recognition: A small body indicates indecision and a long wick reflects rejection from higher prices.

A shooting star signal requires confirmation through indicators or candlesticks, with significance gained after a strong advance, around resistance, or increasing volume. Bearish indicators like MACD crossover or RSI divergence add credibility. Further negative candles confirm the reversal. Placing bearish trades with a shooting star signal requires sound risk management, with stop orders above the candlestick high to protect against premature entries. Shooting stars provide early warnings of trend shifts.

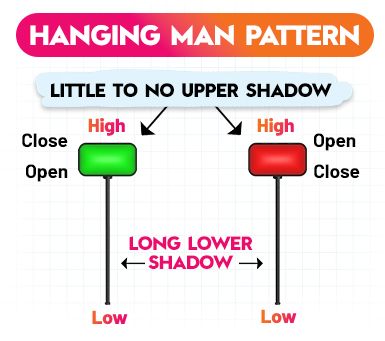

Hanging Man Candlestick Pattern

Hanging man candlestick pattern overview:

- Meaning: Despite the uptrend, buying interest emerged. Bears briefly pushed prices down before buyers resurfaced. Upside conviction is waning.

- Body: Small, bearish body near the top of range. Black or red indicates bearishness.

- Wick: A long lower wick below the body indicates lower intraday trading before the rebound, indicating buying pressure.

- Location: Hanging man in an uptrend, potential lower turn as upside momentum fades.

- Recognition: Small body and long lower wick indicate indecision and rejection of lower prices.

Hanging man signals are traded with confirmation through indicators or additional candlesticks. They gain significance with bearish divergence, increasing volume, or resistance tests. Proper confirmation and risk management are necessary for profitable trades, with initial stops above the candlestick's high limit.

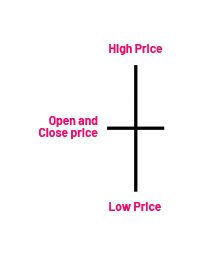

Doji Candle Pattern

Doji Candle candlestick pattern overview:

Meaning: Candle indicates neither bulls nor bears could control, indicating a possible trend reversal.

Body: Small or non-existent, appearing as a cross line on the chart.

Wicks: Upper and lower wicks vary based on the trading range.

Location: Emergence after sustained trends, indicating potential exhaustion and reversals.

Recognition: Cross-like shape reflects the equilibrium between buyers and sellers.

Traders wait for confirmation of a Doji signal before acting. The signal's significance increases at key support/resistance levels, divergence, and higher volume. Follow-on long candles, engulfing patterns, and moving average crossings boost confidence. Counter-trend trades require caution, with stops above/below the doji's range limiting premature entries.

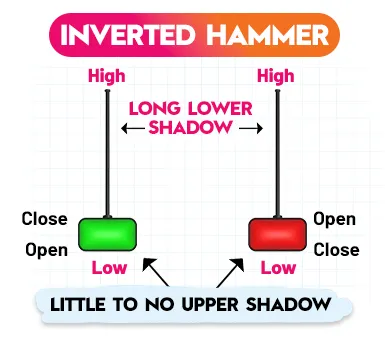

Inverted Hammer Candlestick Pattern

Inverted hammer candlestick pattern overview:

Meaning: diminishing bearish control, building upside momentum, and the potential for bullish trend reversal.

Body: Small, white or green body at the top of the range, indicating bullishness.

Wick: Long upper wick above body indicates price rise but low closing, indicating selling pressure.

Location: Inverted hammer pattern in a downtrend, indicating capitulation as selling pressure wanes.

Recognition: Small body and long upper wick indicate indecision and rejection of higher prices.

Traders wait for inverted hammer signals, which increase significance with bullish divergence, volume, or support tests. Follow-up white candles, doji patterns, and engulfing forms boost confidence. Bullish trades require caution, and inverted hammers flag possible trend shifts requiring follow-through buying.

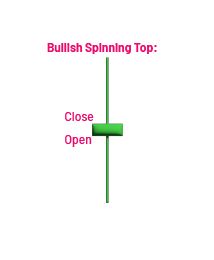

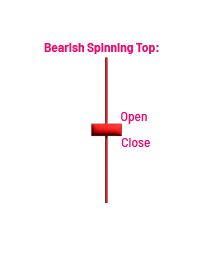

Spinning Top Candlestick Pattern

Spinning top candlestick pattern overview:

Meaning: Mixed trading activity indicates diminishing momentum and potential trend change.

Body: A small body indicates a narrow range between open and closed prices. Mixed colour and small body indicate mixed trading activity.

Wicks: Large wicks indicate volatility between support and resistance.

Location: Spinning tops emerge after uptrends or downtrends, indicating indecision and potential exhaustion.

Recognition: Small real body and large wicks indicate a tight battle between bulls and bears.

Traders wait for confirmation of a spinning top's signal, which increases significance at support/resistance levels, divergence, and expanding volume. Counter-trend trades require caution, with stops above/below the top's range limiting premature entries. Spinning tops indicate probable trend changes that require further action.

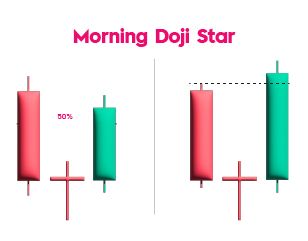

Doji Star Candle Pattern

Doji Star candlestick pattern overview:

- Meaning: Long candle indicates trend extension, and doji reflects market uncertainty. Third Candle, Confirms doji's reversal signalling a shift in supply/demand.

- First Candle: Long-bodied candle indicating momentum.

- Doji: Indicates indecision after the trend, indicating equilibrium between buyers and sellers.

- Third Candle: Candle moving opposite the prevailing trend, indicating a potential reversal.

- Recognition: Doji star shape suggests possible trend change.

- Location: Doji star emerges after an established uptrend or downtrend, signalling waning momentum.

Confirmation of the doji star is needed from indicators, volume, and candlestick follow-through. Moving average crosses, continuation patterns, and bullish/bearish divergence all strengthen the reversal's validity. As stars whipsaw, caution is necessary until confirmation. The range of the doji is used to define the stops above and below it. The doji star indicates trend fatigue that should be confirmed before acting.

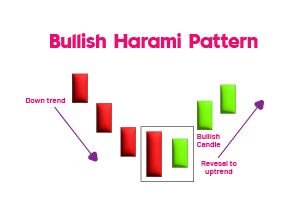

Bullish Harami Candlestick Pattern

Bullish harami candlestick pattern overview:

- Meaning: The first candle shows sustained selling pressure, second reflects growing strength among buyers, indicating upward momentum.

- First Candle: Long red or black candle indicating bearish control.

- Second Candle: Small green or white candle indicating emerging bullish pressure.

- Recognition: The large engulfing candle's pregnant appearance and a small real-body candle's signal a potential trend reversal.

- Location: Harami formation after decline suggests diminishing negative momentum as buyers reappear.

Traders wait for reversal signals through volume, candlestick follow-through, and momentum oscillators. Bullish divergence, climbing trend lines, and moving average crossovers boost optimism. Caution is advised due to false reversals and pattern limit risk.

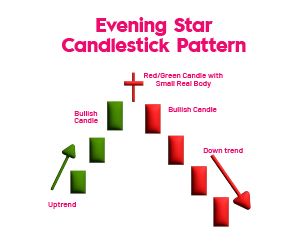

Evening Star Forex Pattern

Evening Star Forex candlestick pattern overview:

Meaning: The buying pressure fades in the first candle, the indecision increases in the middle candle, and the sellers take control in the third candle.

First Candle: Long bullish white or green candle indicating buying pressure.

Second Candle: Small-bodied candle with higher gaps indicating indecision.

Third Candle: Long, bearish red or black candle closing below the first candle, confirming weakness.

Recognition: An evening star shape formed by tall white, small gapped, and long red candles indicates a potential trend reversal.

Location: Pattern emerges after an uptrend, warning of exhaustion in upside momentum.

The pattern's reversal signal requires confirmation from volume, indicators, and candlestick follow-through. Bearish divergence, declining trendlines, and continuation candlesticks boost confidence. Caution is needed, as stars can whipsaw.

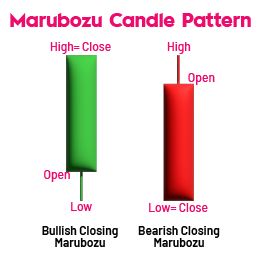

Marubozu Candle Pattern

Marubozu candlestick pattern overview:

Meaning: Intense pressure from bulls or bears without opposition suggests trend prolongation or reverse.

Body: A large, bullish body engulfs candlesticks, indicating bullish control. A dark or crimson body indicates bearish control.

Wicks: Few to no wicks indicate steady price movement.

Location: Emergence aligns with prevailing uptrend or downtrend, indicating continuation.

Recognition: Bold, shaven appearance indicates full control of buyers or sellers.

The marubozu's strong trend signal is reinforced by volume, indicators, and continuation patterns.

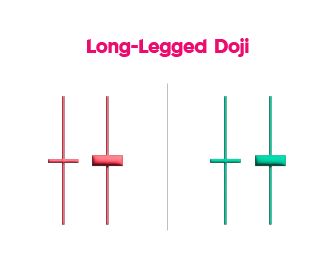

Long-Legged Doji Candlestick Pattern

Long-Legged Doji candlestick pattern overview:

- Meaning: Wide price swings indicate bullish and bearish forces, but closure remains unchanged, indicating potential trend reversal.

- Body: Small or non-existent, appearing as a cross.

- Wicks: Long upper and lower, indicating a wide trading range.

- Location: Long-legged dojis emerge after an established trend, indicating potential exhaustion and reversals.

- Recognition: Lack of body and long wicks reflect indecision.

Traders wait for confirming indicators and candlesticks before using long-legged doji signals. Momentum divergence, volume, and continuation patterns add confidence, but caution is essential. Stops outside Doji range limit risk.

Advantages and Disadvantages of Single Candlestick Patterns

Here are the advantages and disadvantages of single candlestick patterns:

| Advantages | Disadvantages |

|---|---|

| Simple and Easy to Use: Single candlestick patterns are visually appealing and relatively easy to identify on a chart, requiring minimal technical analysis expertise. | Limited Information: Single patterns provide a limited snapshot of price action and should be used in conjunction with other technical indicators or chart formations for confirmation of a signal. |

| Offer Quick Insights: They can provide quick insights into potential price movements, allowing for timely trading decisions based on the signal from the candlestick. | False Signals: These patterns can generate false signals, leading to losing trades if not used cautiously and considering other factors like market trends. |

| Widely Used: These patterns are recognized by many traders, promoting a degree of consistency in technical analysis and offering a common language for traders to interpret market sentiment. | Market Context Matters: The effectiveness of candlestick patterns can be influenced by the overall market trend, volatility, and trading volume. |

| - | Subjectivity in Interpretation: There can be some subjectivity in interpreting candlestick patterns, particularly for less defined patterns, leading to different conclusions by various analysts. |

Conclusion

Therefore, a single candle produces a single candlestick pattern. Traders typically use the 1-day candlestick chart to pinpoint a single candlestick pattern. Japanese Candlestick Formations are Single Candlestick Patterns. They are available in three primary varieties, each with a bullish and a bearish version, and are traded separately. Finally, use a reliable stock market app for trading. Happy trading.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

FAQs on Single Candlestick Patterns

Which is the strongest candlestick pattern?

The strongest candlestick pattern is subjective and depends on context. Patterns like the engulfing pattern or hammer can indicate strong reversals or continuations, but no single pattern is universally strongest.

How do you read a single candlestick?

To read a single candlestick, analyse its open, high, low, and close prices. The body represents the opening and closing prices, while the wicks show the high and low prices.

What is the most reliable candlestick pattern?

The most reliable candlestick pattern often cited is the bullish/bearish engulfing pattern. When the current candle fully engulfs the previous one, it indicates a strong reversal, signalling a shift in momentum.

What is the significance of a doji candlestick pattern?

A doji candlestick pattern occurs when the opening and closing prices are virtually equal, resulting in a very small body with long wicks. It represents market indecision and often signals a potential reversal or continuation, depending on the context.

How can traders use candlestick patterns in their analysis?

Traders can use candlestick patterns to identify potential market entry and exit points. By recognizing patterns such as bullish engulfing, hammer, or shooting star, they can gauge market sentiment and make informed trading decisions.