Top Stories

L&T Partners with PS Technology to Revolutionise Railways

6 mins read. August 2, 2024 at 12:45 PM

Jindal Saw Q1 FY24 PAT Rises 67% to Rs 441 Cr

4 mins read. August 2, 2024 at 12:41 PM

Pfizer Q1 FY25 PAT Zooms 61% to Rs 151 Cr

4 mins read. August 2, 2024 at 12:36 PM

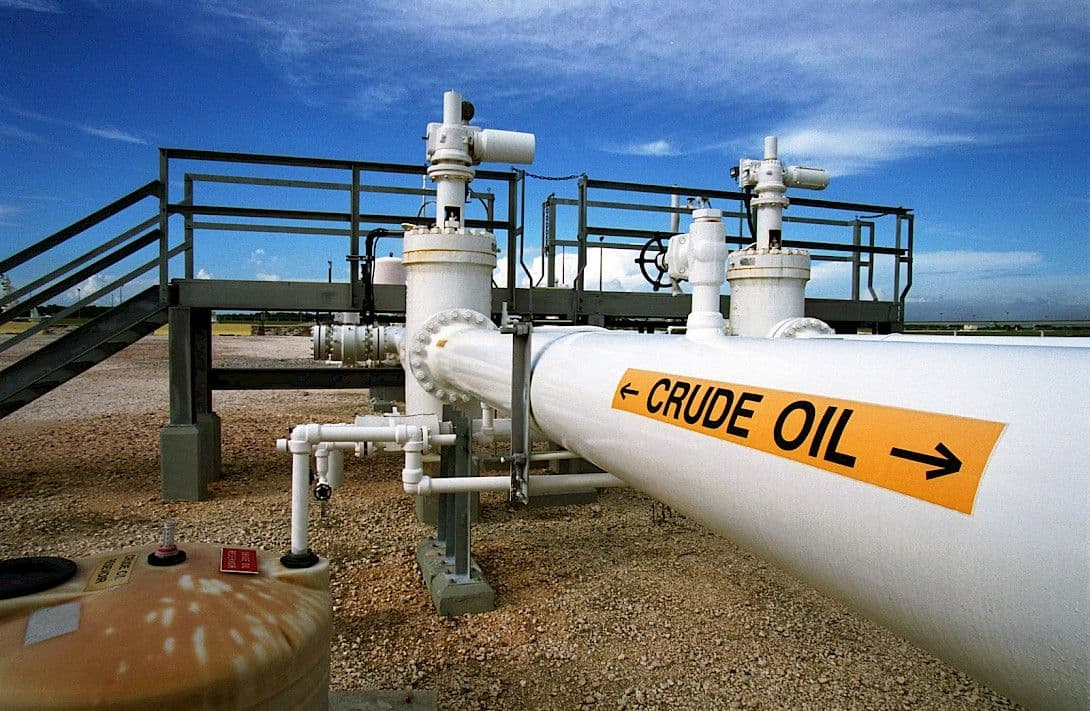

India reduces the levy on the export of diesel and ATF while raising the windfall tax on domestic crude

According to a government notification, the Indian government hiked the windfall tax on crude oil on Friday from Rs 6,700 per tonne to Rs 10,000 per tonne. The revised prices would go into effect on Saturday, September 16.

Additionally, the special additional excise tax (SAED), or duty, on diesel exports would drop from Rs 6 per litre to Rs 5.50 per litre. Jet fuel, also referred to as Aviation Turbine Fuel (ATF), will now only cost Rs. 3.5 per litre as from Rs. 4 per litre. However, SAED on petrol will remain at nil.

Every fortnight, the tax rates are reviewed depending on the average oil price for the previous two weeks. The government's collection from the SAED, imposed on crude oil production and petroleum product exports beginning July 1, 2022, is estimated to be over Rs 40,000 crore in FY2023.

Notably, the government imposes a higher tax rate known as a "windfall tax" on specific industries when they experience unexpectedly above-average profits. To tax higher profits, the government has increased the windfall tax on oil companies when crude prices surpass $90 per barrel.

Petrol, diesel, and aviation turbine fuel (ATF) are all made from refined crude oil that is extracted from the earth and the ocean floor.

On July 1 of last year, India imposed its first windfall profit tax, joining an increasing number of countries that tax energy companies higher-than-average profits. At that time, export duties of Rs 6 per litre ($12 per barrel) were levied on petrol and ATF, and Rs 13 per litre ($26 per barrel) on diesel.

The government taxes oil companies' profits at any price above a threshold of $75 per barrel. The levy on fuel exports is calculated based on the margins or cracks that refiners make from international shipments. These margins are largely the difference between the cost and the realized international oil price.

As crude prices exceed $90 per barrel, the government raises the windfall tax on oil companies to tax higher profits.

Related News

The ₹2000 banknote withdrawal: Where we stand

3 mins read. November 3, 2023 at 08:41 AM

FOMC holds Fed Funds Rate steady with Cautionary Outlook

1 mins read. November 3, 2023 at 08:25 AM

Coal sector records 16.1% growth in September 2023: Centre

2 mins read. November 3, 2023 at 04:09 AM

Indian Railways achieves 87.25 MT freight loading till October 2023

1 mins read. November 2, 2023 at 04:46 AM

Download app

Access BlinkX

everywhere

across device