What is a Red Hammer Candlestick?

- ▶Red Hammer Candlestick Meaning

- ▶Red Hammer Candlestick Formation

- ▶What Does a Red Hammer Candlestick Tell You?

- ▶How to Identify a Red Hammer Candlestick?

- ▶What Does a Red Hammer Candlestick Indicate?

- ▶How to Trade Using the Red Hammer Candlestick?

- ▶Red Hammer vs Other Hammer Patterns

- ▶Common Mistakes When Trading the Red Hammer

- ▶How Can a Red Candlestick be used?

- ▶Strategies for Trading with Red Hammer Candlesticks

- ▶What are the Advantages of a Red Candlestick?

- ▶Limitations of Red Candlesticks

The Red Hammer Candlestick pattern, which is commonly known as the bullish reversal candlestick pattern in the stock market, is often observed at the bottom of downtrends. Investors can recognise the demand and support with the use of the red hammer candlestick pattern. The hammers can alert the traders to the potential that a downtrend may be reversing and that positions that are short may be covered once it has occurred. In this article, we will discuss red hammer candlestick patterns, how to identify them, and strategies to trade this pattern.

Red Hammer Candlestick Meaning

Understanding the Red Hammer Candlestick meaning is crucial for investors. The stock prices get controlled by bulls when the opening and closing prices are nearly the same. The prices have been adjusted over the initial launch price. The hammer might appear towards the end of a downtrend since it is a bullish reversal candlestick pattern. The extended lower shadow suggests that the prices initially went too low by the bears, close to the support. However, the bulls soon arrived, boosted the prices, and eventually closed them above the opening value. In terms of formation, Hammer Red Candlestick and Inverted Hammer are not the same.

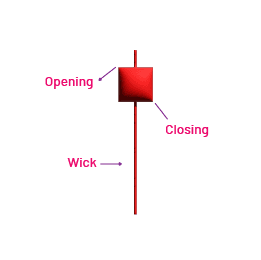

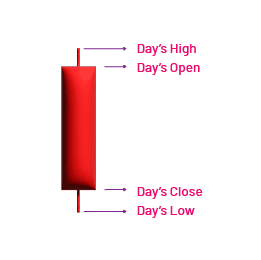

Red Hammer Candlestick Formation

The hammer pattern is a candlestick shape that suggests a possible increase in price after a period of prices going down. It shows up when the opening, closing, and highest prices are about the same, with a long tail going downwards. The red inverted hammer candlestick, observed in downtrends, indicates potential bullish sentiment as it signals a reversal in price direction. This suggests that even though the price went lower, it managed to end higher, indicating that buyers might be taking control.

In a downtrend, where prices keep going lower, a hammer can show that buyers are starting to get stronger and might change the direction of the price. The high closing price of the hammer candlestick means that buyers managed to push the price up, which is a sign they're taking over from the sellers. The inverted red hammer candlestick, appearing during uptrends, signifies potential bearish sentiment as it suggests a reversal in price direction,

Similarly, an inverted hammer also suggests a potential price change, but in a different way. It starts with a low opening, then rises, surprising sellers, but ends near the low again, showing that sellers are still in control.

The hammer is seen as stronger because it ends with a high close, showing buyers strength. Neither pattern is a direct signal to buy or sell, but they can indicate a shift in market sentiment. It's a good idea to practise trading with a demo account to understand these patterns better before using real money.

What Does a Red Hammer Candlestick Tell You?

During a downward trend, the red hammer candlestick indicates a possible bullish turnaround time. The extended lower shadow signals buying pressure as prices go under lower before rising again, while the narrow body shows a decrease in negative momentum. A red hammer candlestick is frequently read by traders as a warning signal of diminishing buying pressure and an oncoming decline. The candlestick pattern known as the red hammer typically appears at the end of downtrends.The red hammer candlestick suggests that the price was initially driven lower by sellers, but before the session concluded purchasers entered and pushed the price back up. The complicated lower shadow suggests strong buying pressure and might offer a hint that the current downtrend is about to reverse.

How to Identify a Red Hammer Candlestick?

Let us have a look on how to identify a red hammer candlestick pattern:

- A red hammer candlestick is a single candlestick reversal pattern with a small red (bearish) body near the top of the candle.

- It has a long lower shadow, usually at least twice the length of the body, indicating strong buying pressure after selling.

- Appears after a downtrend on a candlestick chart analysis, signaling potential price exhaustion.

- The upper shadow is either very small or nonexistent, showing limited upward movement during the session.

- This pattern is part of technical analysis patterns used in price action trading to detect early bullish signals.

What Does a Red Hammer Candlestick Indicate?

- The red hammer candlestick suggests that although sellers pushed prices lower, buyers stepped in to support the market.

- It often signals a potential bullish reversal candlestick formation after a bearish trend.

- The red color shows the close was below the open, but the rejection of lower prices is the key takeaway.

- Traders interpret it as a warning of trend weakening, not a guaranteed reversal.

- In technical analysis, it reflects a shift in market sentiment from selling pressure to buying interest.

How to Trade Using the Red Hammer Candlestick?

- Wait for confirmation, the next candle should close above the red hammer’s high to confirm a bullish reversal candlestick setup.

- Place entries just above the hammer’s high to catch early reversal momentum in price action trading.

- Set a stop-loss below the hammer’s low to protect against false breakouts.

- Combine with volume analysis and support levels for stronger confirmation of reversal.

- Always use this pattern alongside other technical analysis patterns for a robust candlestick chart analysis.

Red Hammer vs Other Hammer Patterns

- Red hammer vs green hammer: Both signal bullish reversals, but a green hammer shows stronger buying sentiment as it closes higher than the open.

- The red hammer candlestick is slightly less bullish since it closes lower, but still suggests buyers defending support.

- Compared to other hammer candlestick patterns, it shares the same shape but differs in color and psychological interpretation.

- It’s related to patterns like inverted hammer or hanging man, which appear in different trend contexts.

- All belong to the single candlestick reversal pattern group used in technical analysis patterns.

Common Mistakes When Trading the Red Hammer

The common mistakes when trading the red hammer are as follows:

- Assuming every red hammer candlestick leads to a reversal without confirmation.

- Ignoring the trend context - a hammer during a sideways market may have little meaning.

- Failing to analyse support/resistance zones in candlestick chart analysis before entry.

- Overlooking volume and broader price action trading signals that validate or invalidate the setup.

- Misunderstanding red hammer vs green hammer differences and applying the same strategy for both.

How Can a Red Candlestick be used?

There are several ways in which traders and technical analysts could use the red hammer candlestick pattern:

- Reversal Signal: After a time when prices have been going up, seeing a red hammer candlestick suggests that prices might start going down instead. Traders might think that the people who want to buy are losing their power, and the people who want to sell might start taking over, which could mean a downtrend.

- Entry or Exit Point: If traders see a red hammer candlestick, it could be a sign for them to start selling or to stop buying if they've been doing so while prices were going up. They might expect prices to start falling after seeing this pattern.

- Confirmation Tool: Traders might not only look at the red hammer candlestick alone. They might also look at other signs or patterns on the charts to make sure they're making the right decision. For example, they might look for more signs that prices are going to start falling.

- Risk Management: If traders own stocks and see a red hammer candlestick forming, they might decide to set a "stop-loss" order. This means if prices keep falling after they sell, they won't lose too much money.

- Market Sentiment: When traders see a red hammer candlestick, it might show that people are starting to feel less confident in the market. They might change their trading plans based on this feeling.

Remember that traders shouldn't rely only on red hammer candlesticks to make their decisions. They should also look at other things like how much trading is happening, what the overall market is like, and if there are any other signs pointing in the same direction.

Strategies for Trading with Red Hammer Candlesticks

Here are five strategies or ways to use red hammer candlesticks for trading:

- Spotting Trend Changes: When a red hammer candlestick appears after prices have been going up, it might mean that the trend is about to change. Traders can wait for other signs, like moving averages or trendlines, to confirm this change before making any trades.

- Confirming Trends: Sometimes, a red hammer candlestick doesn't mean the trend will change, but that it will keep going the same way. Traders can use other indicators to make sure the trend will continue. For example, if prices have been going down and a red hammer shows up, but trading volume increases or a key resistance level breaks, it might mean the downtrend will continue.

- Buying Near Support Levels: If a red hammer candlestick forms near a support level, it could be a good time to buy. The support level acts like a safety net, so traders can set their stop-loss orders there to manage risk. They might expect prices to bounce off the support level and go up.

- Checking with Moving Averages: Traders can use moving averages to check if the signals from red hammer candlesticks are right. If a red hammer forms above a moving average that's going up, it could mean prices will go up more. But if it forms below a moving average that's going down, it could mean prices will keep falling.

- Using Trend Lines Together: Traders can use trendlines along with red hammer candlesticks to find trading chances. For example, if a red hammer shows up near a trendline that's going down, it could mean the downtrend is ending. But if it shows up near a trendline that's going up, it could mean the uptrend will keep going.

By using these strategies, traders can use red hammer candlesticks wisely to make better trading choices and improve how well they do in trading.

What are the Advantages of a Red Candlestick?

Below are the advantages of red hammer candlestick patterns

- Reversal Signals: Red hammer candlesticks appearing after a downtrend can signal potential reversals in the price direction. This helps traders identify opportunities to enter trades at the beginning of upward movements.

- Clear Visual Identification: The distinctive shape of a red hammer candlestick, with a small body and a long lower wick, makes it easy for traders to recognize on price charts. This visual clarity facilitates quick analysis and decision-making.

- Confirmation from Other Indicators: Red hammer candlestick patterns can be confirmed by other technical indicators, such as trendlines or volume analysis. This additional confirmation strengthens the signal and increases traders' confidence in their trading decisions.

- Risk Management: Traders can use red hammer candlestick patterns to set stop-loss orders, helping them manage risk by limiting potential losses if the price moves against their position. This risk management strategy is essential for preserving capital and maintaining trading discipline.

- Market Sentiment Analysis: The appearance of red hammer candlestick patterns provides insights into market sentiment, indicating potential shifts from bearish to bullish sentiment. Traders can use this information to adjust their trading strategies accordingly and capitalise on emerging market trends.

Overall, red hammer candlestick patterns offer traders a valuable tool for identifying potential reversal points and making informed trading decisions in the financial markets.

Limitations of Red Candlesticks

The Red candlestick pattern has several limitations which are shown below.

- Understand Your Trading Platform: It's crucial to understand how your trading platform draws candlesticks. Some platforms consider the prior close, while others don't. Additionally, traders can choose to display candlesticks as filled or hollow based on the close versus open prices.

- Test Platform Functionality: Hover over candlesticks on your trading platform to observe the open and close prices. This allows you to test how your platform interprets candlestick data and how it colours the candlesticks based on these prices.

- Continuous Formation of Price Bars: Price bars are continually forming, providing traders with ongoing data. Price action traders focus on these movements from candle to candle to identify potential trading opportunities, although this approach may not suit everyone's trading style.

- Importance of Overall Picture: While individual candlesticks represent short-term price action, many traders prioritise the overall picture. They look at the broader context to gauge longer-term direction, which is often more significant for investors concerned with the market's general trend.

- Historical Nature of Candlesticks: Candlesticks represent historical data points, reflecting past price movements. While they provide insight into previous market behaviour, traders must remember that they only depict what has already occurred. However, with practice, traders can learn to recognize certain patterns that may indicate potential future price movements in either direction.

Conclusion

Red hammer candlestick is an essential pattern for investors and traders in the stock market. It indicates potential reversal points and making informed trading decisions. They are often observed at the bottom of downtrends and signify bullish reversal sentiments. By recognizing demand and support, investors can anticipate market changes and adjust their positions. However, red hammer candlesticks have limitations, such as reliance on historical data and needing confirmation from other indicators. When combined with other technical analysis tools, they provide valuable insights into market dynamics.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

FAQs on Red Hammer Candlestick

Are Red Candlesticks always bearish?

Red candlesticks, while typically representing periods with lower closing prices than opening prices, do not necessarily signify a bearish sentiment. The understanding of these colours depends on the context of price action and market conditions.

Can Red Candlesticks be used in isolation for trading decisions?

Red candlesticks offer valuable market insights, but their use alone may lead to inaccurate analysis. Traders should consider other factors like trading volume, market conditions, and technical indicators to validate their analysis and improve trading performance.

Are there any other commonly used candlestick colours?

Common candlestick colours include green or white, black, and blue. They represent bullish price movements, bearish price movements, and neutral price movements. These colours aid traders in visualising price action and market sentiment, aiding in technical analysis and decision-making processes.

What role should Red Hammer Candlestick Patterns play in a trader's approach?

Red Hammer Candlestick Patterns can be integrated into traders' trading strategies for market trend analysis and decision-making, requiring a combination of these patterns with other technical analysis tools for a thorough evaluation.

IIs a Red Hammer Candlestick Pattern a dependable indicator at all times?

The Red Hammer Candlestick Pattern offers valuable bullish reversal insights, but it's not a reliable signal alone. Traders should consider factors like trading volume, market conditions, and technical indicators before making decisions.