What is Hedging in the Stock Market?

- ▶<span lang="EN-US" dir="ltr"><strong>How to Create a Hedging Plan?</strong></span>

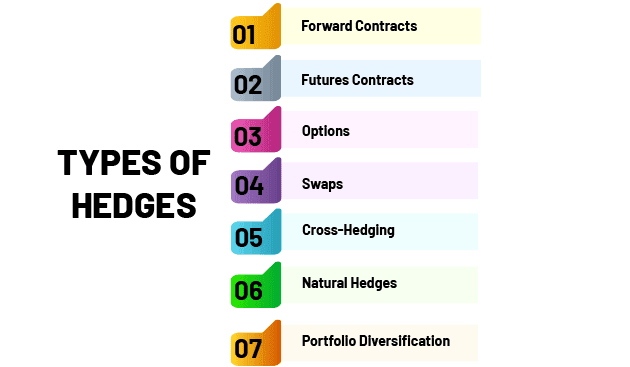

- ▶<span lang="EN-US" dir="ltr"><strong>Types of Hedging with Examples</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Advantages and Disadvantages of Hedging</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Why Do You Need to Hedge?</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Conclusion</strong></span>

Hedging in the stock market generally refers to a risk-management approach that aims to reduce the possible impact of price movements on investments. It usually involves taking an offsetting position so that potential losses in one asset could be balanced by gains in another. This approach helps trader understand how hedging may support disciplined decision-making, especially in uncertain market conditions. The article explains concepts of hedging, planning steps, examples of hedging, its advantages, disadvantages and more to help readers understand what is hedging in a simple manner.

How to Create a Hedging Plan?

The following steps outline how one can create a hedging plan, which may also help clarify the hedging meaning in trading for individuals and help them develop an effective approach to manage market risks.

Identify the Risk

The first step is to recognise the exposure that may need protection. It can relate to price movements, volatility, or market uncertainty.

Define the Objective

The objective generally describes why the hedge is necessary. It may be directed at the reduction of possible loss or at the stabilisation of portfolio exposure.

Choose a Suitable Strategy

A strategy is selected based on the objective. It may include a particular futures contract or an options position.

Choose the Financial Instrument

The financial instrument is chosen as per the strategy. It may include a particular futures contract or an options position.

Determine the Hedge Ratio

The hedge ratio usually reflects how much of the exposure will be covered. It is based on risk tolerance and position size.

Execute the Hedge

The position is placed in the market as per the planned approach. This step typically involves entering the chosen contract.

Monitor and Review

The hedge is reviewed at intervals so that it can stay aligned with the objective, and adjustments may be made if market conditions change.

Types of Hedging with Examples

This section explains different types of hedging in trading using simple examples so that readers can understand how different approaches usually work.

Forward Contract Hedging

A forward contract usually allows two parties to agree on a future price for an asset. It can help reduce uncertainty linked to price changes.

For example, an Indian exporter locks in the exchange rate through a forward contract so that possible currency fluctuations may not affect the payment value.

Futures Hedging

A futures contract typically involves agreeing to buy or sell an asset at a later date. It can support protection against expected market movements.

For example, a farmer could sell futures on a crop to lock in a price before harvest so that future market fluctuations may have less impact.

Options Hedging

An options contract generally gives the right, but not the obligation, to buy or sell an asset. It can limit downside exposure while retaining some flexibility.

For example, an investor holding shares could buy a put option so they may sell those shares at a fixed price if the market falls.

Commodity Hedging

Commodity hedging may help stabilise the cost of raw materials or goods by locking in prices to manage market fluctuation risk.

For example, a producer of corn may sell corn futures ahead of harvest to lock in a sale price in case market rates decline.

Currency Hedging

Currency hedging can reduce the effect of foreign exchange movements on international transactions or investments.

For example, an exporter expecting payment in a foreign currency could use a forward contract to fix the exchange rate and reduce the risk of currency value changes.

Pair Trading

Pair trading usually includes taking opposite positions in two related securities. It can help balance exposure when price differences move in varied directions.

For example, an investor may go long on one stock and short on another related stock so that if one declines, losses may be partly offset by gains in the other.

Advantages and Disadvantages of Hedging

Here are the key advantages and disadvantages of hedging that investors must be aware of.

| Advantages of Hedging | Disadvantages of Hedging |

| 1. Short-term risk reduction for long-term traders using futures. | 1. The cost involved may offset profit. |

| 2. Locking profits using hedging tools. | 2. Reduced risk often means reduced profits. |

| 3. Survival during challenging market periods. | 3. Complexity for short-term traders like day traders. |

| 4. Protection against various market changes. | 4. Limited benefits during favourable or sideways market movements. |

| 5. Time-saving due to less need for frequent portfolio adjustments. | 5. Higher capital or account requirements for options or futures. |

| 6. Complex options strategies for maximising returns. | 6. Demands high trading skills and experience. |

Why Do You Need to Hedge?

Hedging is a crucial tool for investors to control risk. Balancing investment risks helps to reduce possible losses and safeguard earnings. Investors may decide to hedge for many reasons, including:

- Market volatility protection: Hedging is valuable for reducing volatility, particularly under fluctuating or unclear market circumstances. By hedging, investors can reduce possible losses and restrict their exposure to market risks.

- Diversification: Hedging can help diversify an investment portfolio by mitigating the risks connected to certain assets or industries. This may contribute to the portfolio's increased stability and decreased overall risk.

- Managing downside risk: Investors can minimise their losses if the market swings against their position by hedging to mitigate downside risk.

Disclaimer: All investments are subject to market risks, economic conditions, regulatory changes, and other external factors. Returns are not guaranteed and may vary based on market performance and investment tenure. Investors should assess their risk tolerance and financial objectives, conduct their own research, and consult a qualified financial advisor before making any investment decisions.

Conclusion

Hedging in the stock market helps investors manage risk by using offsetting positions, careful planning, and suitable strategies. By learning techniques like futures, options, currency, and commodity hedging, investors can make better and more balanced decisions. Although it needs some planning and understanding, hedging reduces potential losses, manages downside risk, and adds stability. A reliable trading app can make executing and monitoring these strategies easier and more convenient.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

FAQs on What is Hedging in Stock Market

What is hedging?

Hedging is a financial strategy aimed at reducing or mitigating the risk of potential losses from price fluctuations, market volatility, or unexpected events by using various financial instruments.

Is hedging the same as speculation?

No, hedging is a risk management strategy aimed at reducing potential losses. Speculation involves taking positions on price movements to profit from market fluctuations. Both hedging and speculation are different.

Is hedging suitable for everyone?

Hedging is a complex strategy that requires an understanding of financial instruments and market dynamics. It may not be suitable for all investors and individuals, and seeking advice from financial professionals is recommended before implementing a hedging strategy.

Can individuals benefit from hedging?

Yes, individuals can benefit from hedging, especially when dealing with currency exchange for travel or investments in different markets.

How does hedging impact profits and losses?

Hedging can limit potential losses but may also restrict potential gains. While it aims to protect against downside risk, it may come at a cost regarding premiums, fees, or missed opportunities.