Home

Minor Demat Account: Understanding It’s Features & Benefits

A minor Demat account is a specialised investment account designed specifically for minors. This provides them with an opportunity to engage in investing and asset management. It operates under the guidelines set by regulatory bodies like the Securities and Exchange Board of India (SEBI) and offers a range of features and benefits that can contribute significantly to minors' financial well-being in the long run.

Investing at a young age provides minors with a significant advantage in terms of capitalising on compounding returns. Through a minor Demat account, young investors can explore a range of financial instruments such as equities, mutual funds, bonds, and more, which have the potential to generate substantial returns over time. This early exposure to investment opportunities can pave the way for a financially secure future.

Who can open a minor Demat account in India?

To invest in the Indian market, you need to own a Demat account. These accounts will let you keep all your holdings in electronic format. There are two depositories in India these are the CDSL and NSDL. The DPs permit the process of buying and selling shares. Any individual can open Demat account online.

While opening the minor Demat account, the guardian has to submit documents like the minor's birth certificate, their own ID and address proof, relationship proof and a recent photograph of the minor. Most depository participants (DPs) and brokers have specific minor account opening forms to be filled out by guardians.

Apart from submitting the account opening form, the KYC of the minor and guardian must also be completed. On turning 18, the minor has to provide their own identity and address proof to take control of their Demat account.

Overall, a minor Demat account makes it possible for guardians to invest in securities on behalf of their children. This helps initiate children into investing early. However, all transactions and holdings remain under the supervision of the appointed guardian until the minor reaches maturity

Table of Content

- Who can open a minor Demat account in India?

- Features Of Minor Demat Account

- Benefits of Demat Account For Minors

- Limitations of Minor Demat Account

Features Of Minor Demat Account

- Limited Control

Since the account is operated by the parent or guardian on behalf of the minor, the minor has limited control over the account until they reach the age of majority (usually 18 years old). The parent or guardian acts as the authorised signatory and makes investment decisions on behalf of the minor.

- Joint Holding

A minor Demat account is typically held jointly by the minor and the parent or guardian. The parent or guardian's name appears before the minor's name in the account, indicating their role as the primary account holder.

- Trading Restrictions

To protect minors' interests, certain trading restrictions are imposed. Minors are not allowed to engage in intraday trading, short-selling, or trading in derivative instruments. They can only invest in stocks, mutual funds, government securities, and other permissible securities.

- Parental Consent

Any transactions made in the minor Demat account require prior consent from the parent or guardian. This ensures that the investments align with the financial goals and risk tolerance of the minor's family.

- Separate Portfolio

Although the minor Demat account is linked to the parent or guardian's primary Demat account, it maintains a separate portfolio for the minor's investments. This allows for easier tracking and management of the minor's holdings.

- Conversion to Major Account

Once the minor reaches the age of majority, the minor Demat account can be converted into a regular demat account in the minor's name. The account holder needs to provide the necessary documents and complete the conversion process as per the regulations of the depository participant.

- Taxation

The tax liability for investments made through a minor Demat account is borne by the minor. The income generated from these investments is clubbed with the parent or guardian's income for tax purposes. This is subject to certain exemptions and provisions under tax laws.

- Education and Awareness

Depository participants often provide educational resources, workshops, and seminars to enhance financial literacy among minors. This helps them develop a better understanding of the stock market and investment principles.

- Nomination Facility

A minor Demat account allows for the nomination of a beneficiary in case of the unfortunate demise of the parent or guardian. This ensures a smooth transfer of assets and prevents any legal complications.

- Transferability

In the event that the parent or guardian wishes to transfer the minor demat account to another guardian or individual, such transfers are possible. The necessary procedures and documentation need to be followed to effect the transfer.

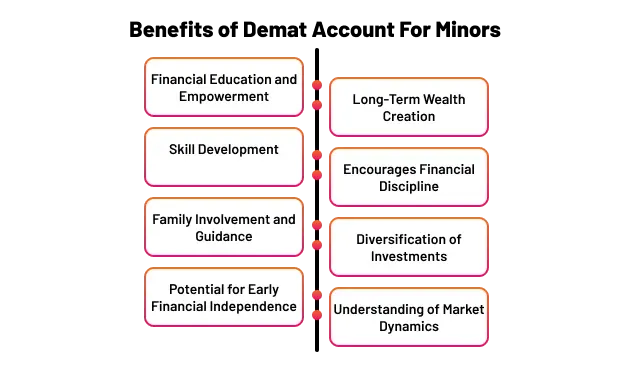

Benefits of Demat Account For Minors

You can find some of the benefits of a Demat Account for minors are as follows:

Limitations of Minor Demat Account

- Some of the limitations of the Demat account is that the minor cannot independently operate the Demat account until they turn 18 years old. All transactions must be routed through an appointed guardian who controls account.

- There are restrictions on the maximum holding value in a minor Demat account. SEBI regulations stipulate this limit to be Rs 1 lakh per exchange or Rs 2 lakhs overall.

- Trading options are limited as margins and derivatives trading are typically not allowed in minor accounts by brokers.

- While the account can be opened with a nomination, the nominee cannot undertake any transactions or operations till the minor turns major. On turning 18, the minor has to submit separate documents and get their signature attested to assume full control of the Demat account.

Conclusion

A minor Demat account serves as a powerful tool for introducing minors to the world of investing, financial management, and long-term wealth creation. By opening a Demat account at a young age, minors gain the opportunity to develop crucial financial skills. It empowers them to take charge of their financial future, encouraging a sense of responsibility and discipline. Through the trading app you can trade with confidence and seize opportunities like never before.

Recent Articles

Related Articles

Press Release

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists