Eligibility Criteria To Open A Demat Account

- ▶Who is Eligible to Open a Demat Account?

- ▶Eligibility Criteria to Open a Demat Account

- ▶Documents to open Demat Account

- ▶Benefits of opening a Demat account

Effective investment management is essential in the current digital era, and a Demat account is an essential tool for this. Without the need for physical certificates, keeping and trading shares and securities electronically requires a Demat account, also known as a Dematerialized account. Before entering the world of electronic trading, it is important to understand the requirements for obtaining a Demat account. By doing this, you can be confident that you'll be ready to handle the application procedure and get the most out of your money. We'll go over the crucial requirements for Demat account eligibility in this article, which will help you get started in the stock market faster as well as improve your investing knowledge. With the help of this blog understand the eligibility criteria to open a demat account.

Who is Eligible to Open a Demat Account?

To invest in stock markets or before receiving an allocation in any upcoming IPO, it's crucial to understand the eligibility for opening a Demat account. The following individuals/entities are eligible to establish a Demat account

- Resident Individual

A person is considered a resident for the tax year if they are physically present in India for 182 days or more, or if they have stayed in India for 365 days or more in the immediately preceding four years and 60 days or more in the relevant financial year.

- Hindu Undivided Family (HUF)

An HUF comprises individuals who are direct descendants of a common ancestor, including male ancestors' wives and daughters. The family is led by the Karta, usually the oldest member, while other family members are coparceners.

A Demat account for HUF is opened in the name of the oldest male family member or 'Karta,' who acts as the signatory authority for all trading and Demat account transactions unless otherwise specified.

- Domestic Corporation

A domestic corporation refers to a business operating within its home country. It is subject to distinct regulations compared to non-domestic enterprises and may incur tariffs or fees on imported goods.

- Overseas Indians

Non-resident Indians (NRIs) are individuals of Indian origin residing in India for less than 182 days during the preceding financial year, or those who have left India or are living abroad for employment purposes.

- NRIs can participate in Indian capital markets by opening a Demat account through a chosen Depository Participant (DP). In their account opening application, they must specify it as an NRI Account.

- Clearing Member

A clearing member, also known as a pool account, represents a broker's portfolio where the broker holds securities belonging to their clients. This account is where securities from central depositories are gathered by the broker.

Eligibility Criteria to Open a Demat Account

To be eligible for opening a Demat account in India, an individual must fulfill the following requirements:

- Age: The Demat account eligibility age is over 18 years.

- KYC documents: The individual must have valid Know Your Customer (KYC) documents such as a PAN card, Aadhaar card, passport, driving license, voter ID, or NREGA job card.

- Bank account: The individual must have a bank account with an RBI-registered bank.

- Proof of address: The individual must have a valid proof of address, such as a utility bill, bank statement, or rent agreement.

- Income proof: Some brokers may require income proof, such as salary slips, income tax returns, or bank statements.

- Nationality: The individual must be an Indian citizen or a non-resident Indian (NRI).

- Fees: The individual must be able to pay the account opening fees, annual maintenance charges, and transaction fees charged by the broker.

Various entities such as individuals, firms, companies, trusts, and foreign nationals can hold a Demat account in the Indian stock market. The above are some of the eligibility criteria to open a Demat account in India. To clarify the eligibility for a Demat account, it is important for investors to thoroughly review the specific requirements outlined by their chosen brokerage firm.

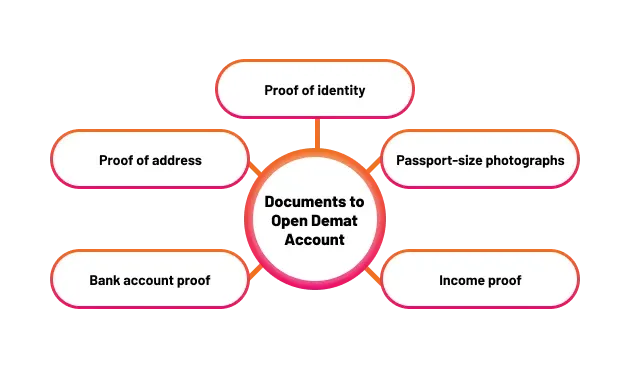

Documents to open Demat Account

To open a Demat account in India, an individual must provide the following documents:

- Proof of identity: This can be any one of the following documents: PAN card, Aadhaar card, passport, driving license, voter ID, or NREGA job card.

- Proof of address: This can be any one of the following documents: utility bill, bank statement, rent agreement, passport, or driving license.

- Passport-size photographs: The number of photographs may vary among different brokers, but generally, two passport-size photographs are required.

- Bank account proof: This can be a canceled cheque, bank statement, or passbook with a clear mention of the account holder's name, account number, and IFSC code.

- Income proof: This may be required by some brokers and can include salary slips, income tax returns, or bank statements.

It is important to note that the required documents may vary slightly among different brokers or Depository Participants (DPs), and fees will be charged for account opening, maintenance, and transactions. The Demat account eligibility varies from broker to broker but almost all trading platforms ask for the same documents as well as the process to open an online Demat account.

Benefits of opening a Demat account

As you are eligible to open a Demat account you can get the following benefits and do uninterrupted online trading.

1. Secure and confidential digital storage: A Demat account offers an option for holding securities such as securities, bond funds, ETFs, and commodities safely and securely. By doing this, the chance of physical certificates getting misplaced, stolen, or damaged is gone.

2. Trading is made simple: With a Demat account because it enables speedy transfer & settlement of securities. Additionally, it gives users access to Internet trading platforms where they can purchase and sell stocks at any time and from any location.

3. Regulation compliance: In India, a Demat account is required to trade on the stock market. Investors can keep up with SEBI's (Securities and Exchange Board of India) regulatory requirements for trading in securities by holding a Demat account.

4. Multiple holding options: Opening a Demat account allows you to hold securities in a variety of ways. Accounts can be formed by individuals, businesses, trusts, and other legal entities. Additionally, it enables investors to centralize their holdings, investing tracking easier and using less paper.

As you learn about the eligibility criteria to open a demat account, and you know what advantages you get after opening a demat account, you can try a reputable broker that provides you with the tech and guidance to trade. You can open your Demat account with the BlinkX Demat app as it offers better technology and an easy-to-manage trading platform.

Conclusion

Going through the demat account eligibility in India is quite straightforward. The basic requirements are that the account holder must be 18 years or older, and have valid KYC documentation including a PAN card, Aadhaar card, and proof of address. NRIs, foreign nationals, and foreign companies can also open Demat accounts in India, which can be the NRE and NRO Demat accounts. Lastly, the ideal requirements for Indian residents are minimal & the process to Open a Demat account online through an online trading app is simple.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

Demat Account Eligibility FAQs

Can a minor open a Demat account?

No, a minor cannot open a demat account in India. The eligibility criteria to open a demat account state that the individual must be over 18 years of age.

Can a non-Indian citizen open a Demat account?

Yes, foreign nationals residing in India can open a demat account. Non-resident Indians (NRIs), Persons of Indian Origin (PIOs), Foreign Institutional Investors (FIIs), and Foreign Portfolio Investors (FPIs) are also eligible to hold a demat account.

Is it mandatory to have a bank account to open a Demat account?

Yes, it is mandatory to have a bank account with an RBI-registered bank to open a Demat account in India.

Is income proof required to open a Demat account?

Some brokers may require income proof, such as salary slips, income tax returns, or bank statements. However, it may not be required by all brokers.

Can a partnership firm open a Demat account?

Yes, partnership firms, limited liability partnerships (LLPs), companies, trusts, and other legal entities are eligible to hold a demat account in India. But you need to check the broker eligibility criteria to open a demat account under the partnership category.