How Did Rakesh Jhunjhunwala Become a Billionaire?

Mr. Rakesh Jhunjhunwala, the man, needs no introduction. The ‘Big Bull’ of the Indian Stock Market, often called ‘The Warrant Buffet of India,’ was an ace stock market investor. Born on July 5, 1960, Mr. Rakesh Jhunjhunwala went on to become one of the richest persons in India with an estimated income of around $5.8 billion (as of 2022). Keep reading to learn more about Rakesh Jhunjhunwala’s journey.

A few years ago… background story

Mr. Rakesh Jhunjhunwala completed his schooling in Mumbai and pursued his degree in commerce from Sydenham College. Later, he pursued his career as a chartered accountant, which was followed by becoming the ‘Big Bull’ of the Indian stock market. Since his college days, Mr. Rakesh Jhunjhunwala had a keen interest in the stock market and spent hours studying and analyzing companies.

In the early 1980s, Mr. Rakesh Jhunjhunwala began his investment journey by investing in small stocks. However, he had a strong investment philosophy which was based on heavy market research and a long-term approach to investment. This made him identify undervalued companies with strong growth potential. His belief made him hold onto these types of shares for an extended period, which helped him to navigate through various market cycles.

Table of Contents

And..the journey continues…

Mr. Rakesh Jhunjhunwala’s keen observation of the market trends and analysis of the performance of different listed companies in the stock exchange made him create a league of his own. He made significant capital investments in blue-chip companies, including Tata Power Ltd., between 1986 and 1989. Later, the stock price rose to ₹1,200 a piece, which doubled his investment. The rise in share price also helped his ₹2 million assets surge to ₹5.5 million with a small investment.

A few of Mr.Rakesh Jhunjhunwala’s early investments include Metro Brands, Star Health, and Allied Insurance, which paid off well when these firms went public in 2021. Another early investment, which was the crown jewel of his portfolio was the investment in jewelry and watch maker Titan (Tata Group). He made investments at ₹40 in 2003, and in the next 20 years, the stock price rose up by 83,250%.

Vedanta Ltd., formerly known as Sesa Goa, was also one of his early investments, for which he brought almost 400,000 shares. The price of these stocks was battered due to the fall in prices of iron ores. Rakesh Jhunjhunwala invested in Praj Industries Ltd., a company in the Indian ethanol plant sector. He held the stocks for a long time, buying it when the index was at 5,500 points and selling it at 12,000 points. This generated a significant gain of 250 % in the stock.

Rakesh Jhunjhunwala Portfolio

Wondering how Mr. Rakesh Jhunjhunwala became a billionaire. Below is the list of Rakesh Jhunjhunwala portfolio:

Rakesh Jhunjhunwala and Associates’s Portfolio

| Rakesh Jhunjhunwala Net worth | 52,179 Cr. |

| Company Holdings | 26 |

Rakesh Jhunjhunwala net worth in rupees: ₹52,179 crore (at the time of his passing in 2022).

Latest Portfolio of Rakesh Jhunjhunwala Stocks (As of June 2025)

| Stock Name | Quantity Held | Holding Percentage | Holding Value (Crs) |

| Canara Bank | 132,443,000 | 1.5% | 1,403.9 |

| Star Health and Allied Insurance Company Ltd | 100,753,935 | 17.1% | 4,388.3 |

| Inventurus Knowledge Solutions Ltd | 84,668,326 | 49.3% | 13,606.2 |

| NCC Ltd | 78,333,26 | 12.5% | 1,684.2 |

| Tata Motors Ltd | 47,770,260 | 1.28% | 3,105.3 |

| Titan Company Ltd | 45,793, 470 | 5.32% | 15,180.5 |

| Federal Bank Ltd | 36,030,060 | 1.5% | 669.4 |

| Karur Vysya Bank Ltd | 33,487,516 | 4.27% | 877.2 |

| Fortis Healthcare Ltd | 30,739,000 | 4.1% | 2,643.6 |

| Indian Hotels Company Ltd | 28,810,965 | 2.0% | 2,138.6 |

| Metro Brands Ltd | 26,102,394 | 9.60% | 3,110.9 |

| Concord Biotech Ltd | 25,199,240 | 24.1% | 4,364.8 |

| Valor Estate Ltd | 25,000,000 | 4.6% | 455 |

| Aptech Ltd | 24,019,236 | 41.4% | 318.9 |

| Geojit Financial Services Ltd | 20,099,400 | 7.20% | 147.1 |

| Jubilant Pharmova Ltd | 10,244,000 | 6.4% | 1,180.3 |

| Va Tech Wabag Ltd | 5,000,000 | 8.0% | 789.5 |

| Jubilant Ingrevia Ltd | 4,735,500 | 3.06% | 357.7 |

| Tata Communications Ltd | 4,500,687 | 1.58% | 749.8 |

| Singer India Ltd | 4,250,000 | 6.95% | 27.8 |

| Crisil Ltd | 3,799,000 | 5.2% | 1,983.1 |

| Wockhardt Ltd | 2,837,005 | 1.89% | 457.1 |

| Baazar Style Retail | 2,532,500 | 3.4% | 72.2 |

| Raghav Productivity Enhancers Ltd | 2,205,704 | 4.80% | 138.4 |

| Sundrop Brands | 1,861,759 | 4.9% | 154.5 |

| Escorts Kubota Ltd | 1,708,388 | 1.58% | 563.8 |

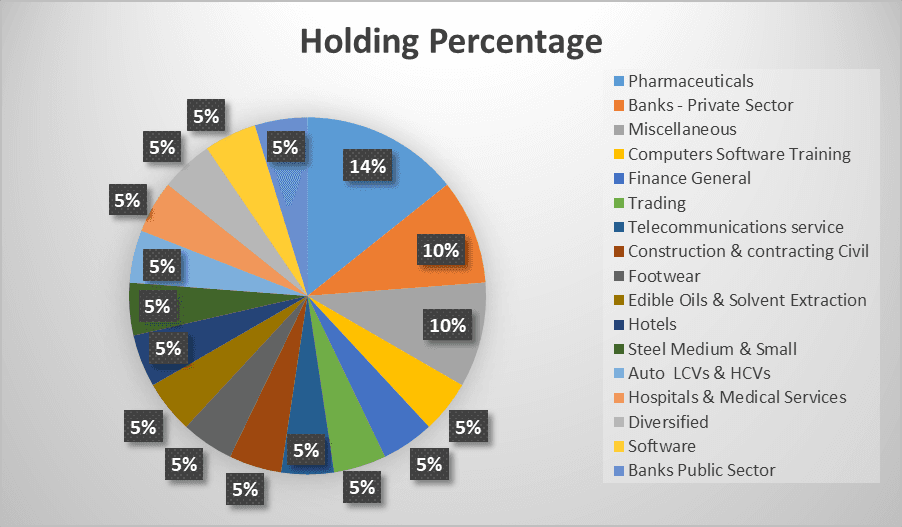

The sector-wise breakup of holdings

| Sectors | Holding Percentage |

| Pharmaceuticals | 12% |

| Banks - Private Sector | 8% |

| Miscellaneous | 8% |

| Computers Software Training | 4% |

| Finance General | 4% |

| Trading | 4% |

| Telecommunications service | 4% |

| Construction & contracting Civil | 4% |

| Footwear | 4% |

| Edible Oils & Solvent Extraction | 4% |

| Hotels | 4% |

| Steel Medium & Small | 4% |

| Auto LCVs & HCVs | 4% |

| Hospitals & Medical Services | 4% |

| Diversified | 4% |

| Software | 4% |

| Banks Public Sector | 4% |

Learning from Rakesh Jhunjhunwala’s journey

Often known as the "Big Bull" of the Indian stock market, Rakesh Jhunjhunwala was a well-known and successful investor in India. Rakesh Jhunjhunwala’s excellent market knowledge and belief helped him achieve great heights in his highly celebrated career. He advised the investment community to avoid focusing on a stock's performance based on a single-day correction or a poor quarterly result. Instead, he emphasized evaluating a stock based on its long-term performance.

Below are a few of his learnings:

- Emphasizing a long-term perspective.

- Conducting extensive analysis and research on companies before investing.

- Be patient and do not make any impulsive decisions based on short-term market movements.

- Do not follow the herd mentality in the stock market.

- Should believe in diversifying the portfolio across different sectors and companies to reduce risk.

Conclusion

Today, with the increase in the popularity of the stock market, there has been a significant rise in investors. Unfortunately, there can’t be another influential personality like Mr. Rakesh Jhunjhunwala in the share market. However, his learnings and principles should be followed, which pushed investors to be consistent, patient, and disciplined with their investments.

| You may also be interested to know | |

1. | What is a Portfolio? |

2. | How to make money in stock market? |

3. | How to increase ipo allotment chance? |

4. | How To Apply IPO Under HNI Category? |

5. | Forex Market Timing in India |

FAQs on Mr. Rakesh Jhunjhunwala

How did Mr. Rakesh Jhunjhunwala become a big bull?

Mr. Rakesh Jhunjhunwala became a big bull by investing in significant capital investments in blue-chip companies including Tata Power Ltd between 1986-89. Later, the stock price rose to ₹1,200 a piece which doubled his investment. The rise in share price also helped turn his ₹2 million assets surge to ₹5.5 million with a small investment.

Through which AMC, did Mr. Rakesh Jhunjhunwala invested in stocks?

RARE Enterprise Ltd is the asset management firm that managed Rakesh Jhunjhunwala’s investment portfolio. The company is a member and is listed with the NSE, BSE, and other exchanges across all verticals.