Demat Account Charges and Fees

- ▶<span lang="EN-US" dir="ltr"><strong>Demat Account Charges Levied by BlinkX </strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Different Types of Demat Account Charges</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>How to Reduce Demat Account Charges?</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Factors Affecting Demat Charges</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Points to Consider Before Opening a Demat Account</strong></span>

- ▶<span lang="EN-US" dir="ltr"><strong>Conclusion</strong></span>

Demat accounts provide convenience for investments and trading in India. However, these accounts involve certain charges that account holders need to understand. A Depository Participant (DP), such as a brokerage firm or bank, facilitates the opening of a Demat account. Some DPs include nominal opening charges, whereas others offer free accounts for the first year before charging from the second year onwards. Awareness of these charges helps individuals make informed financial decisions. The following sections explain the various charges associated with Demat accounts in India.

Demat Account Charges Levied by BlinkX

Here are some of the charges that are applied by BlinkX -

| Charges | Details of Applicable Charges |

| Annual Maintenance Charges (AMC) | No annual maintenance fee is applied. |

| Demat Transaction Charges | A charge of ₹30 is applied for the sell transaction. |

| Dematerialisation – Per Certificate | For up to five certificates, the cost is ₹50 each. For more than five, an extra ₹10 is charged per certificate. |

| Rematerialisation | Charged at ₹20 per certificate, with a minimum fee of ₹50. |

| Market Margin Pledge – Creation / Closure / Invocation | A fixed charge of ₹10 applies for each request. |

| SEBI MTF Pledge – Creation / Closure | Each pledge action under SEBI MTF attracts a fee of ₹25. |

| Account Statements | Each statement issued is charged at ₹20. |

| Additional Physical Statements | If extra physical copies are required, each copy costs ₹50. |

Read More: Brokerage Charges and Plans at BlinkX

Different Types of Demat Account Charges

These charges cover account opening, annual maintenance, trans actions, and other services. Each Demat account fee varies across DPs and depends on the type of account.

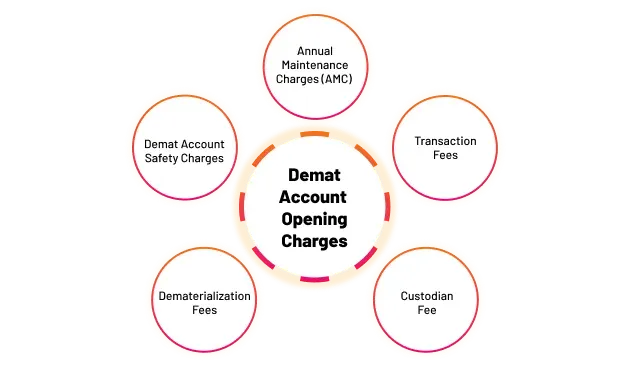

Demat Account Opening Charges

A one-time fee is charged by the DP when a new Demat account is opened. The fee ranges from zero to a few hundred rupees, depending on the DP. Many broking firms offer seamless account opening through online trading platforms without charging opening fees. However, stamp duty, GST, and other statutory levies by SEBI apply where applicable. Banks offering a 3-in-1 account comprising a savings account, trading account, and Demat account typically provide free account opening. Comparing opening charges across DPs helps in selecting the most suitable option.

Annual Maintenance Charges (AMC)

The DP charges an annual fee to maintain the Demat account. AMC varies based on the DP and account type. Individual accounts typically incur charges between Rs. 250 and Rs. 1,000 per year. Corporate accounts may have an AMC of up to Rs. 5,000 annually. Demat accounts do not impose minimum balance or holding requirements. SEBI removed annual maintenance charges for debt securities up to Rs. 50,000 under the Basic Services Demat Account (BSDA) from 1st June 2019. For holdings between Rs. 50,000 and Rs. 2 lakhs, a maximum charge of Rs. 100 plus applicable taxes applies.

Transaction Fees

DPs charge transaction fees for each activity on the Demat account, such as buying or selling securities. These fees depend on the transaction value and vary across DPs. The charges may be structured as a percentage of the transaction value or a flat fee per transaction. Transaction fees are levied when securities enter or exit the Demat account. Some DPs charge transaction fees monthly, whereas others charge only during the sale of securities. The fee structure differs based on whether the transaction involves buying or selling.

Custodian Fees

The depository charges custodian fees for storing securities in electronic form. This fee represents a small percentage of the securities' value. DPs typically impose custodian fees on a quarterly or annual basis. The charge ensures the safekeeping and management of electronic securities held in the account.

Dematerialisation Fees

Dematerialisation fees apply when physical securities are converted into electronic format. DPs charge a fixed fee per certificate for this service. The charges vary across different DPs. This fee facilitates the transition from paper-based certificates to electronic holdings in the Demat account.

Demat Account Safety Charges

Safety charges ensure the protection of securities held electronically by the DP on behalf of traders. Before Demat accounts, traders maintained physical security certificates themselves. DPs now charge a small safety fee for safeguarding these electronic holdings. The fee depends on the number of securities held in the account. Most DPs levy this charge monthly. The fee ranges from Rs. 0.5 to Rs. 1 per International Securities Identification Number (ISIN).

How to Reduce Demat Account Charges?

To reduce the Demat account charges, individuals need to have a strategic approach and awareness about the fee structure associated with maintaining such accounts. Here are some useful strategies to minimise the Demat account charges:

- Opt for a Basic Services Demat Account (BSDA) if the holdings are below a certain threshold.

- Consolidate the holdings into a single Demat account to reduce account maintenance charges.

- Choose a Demat account with lower transaction fees and annual maintenance charges.

- Be aware of account closure charges and choose an account with lower or no closure fees.

- Keep an eye on the account activity and avoid unnecessary transactions to minimise charges.

- Negotiate with the Demat service provider for reduced fees, particularly for high-value traders.

- Use online and electronic statements to save on physical statement charges.

- Opt for a discount brokerage that offers competitive Demat Account charges.

- Stay informed about any regulatory changes that may impact Demat charges.

Individuals can also save on Demat account charges by using an online brokerage calculator. It can help them pre-plan and save lots of capital on their trade.

Factors Affecting Demat Charges

Different factors influence the total cost of maintaining a Demat account.

Type of Depository Participant

Different DPs, including full-service brokers, discount brokers, and banks, charge varying fees. Full-service brokers typically have higher charges compared to discount brokers due to the additional services offered.

Account Type

Individual and corporate accounts attract different charge structures. Corporate accounts generally incur higher annual maintenance charges compared to individual accounts due to increased complexity and volume of transactions.

Transaction Volume

The frequency and volume of transactions influence the overall charges. Higher transaction volumes may lead to increased transaction fees, although some DPs offer reduced rates for frequent traders.

Value of Holdings

The total value of securities held in the Demat account affects custodian fees. Accounts with larger holdings typically incur higher custodian charges as the fee is calculated as a percentage of holdings.

Service Level

The range of services provided by the DP impacts charges. Full-service brokers offering research, advisory, and premium support charge higher fees compared to basic service providers.

Promotional Offers

DPs occasionally offer promotional schemes, including waived opening charges or reduced AMC for the first year. These temporary offers could significantly lower initial costs for new account holders.

Points to Consider Before Opening a Demat Account

The following parameters should be considered before opening a Demat account.

Brokerage Charges

A fee applies whenever securities are bought or sold through the account. The charge structure can be a fixed amount per transaction or a percentage of the transaction value. Understanding the brokerage fee helps in estimating trading costs.

Annual Fee

An annual maintenance fee is charged once per year. This fee typically ranges from Rs. 500 to Rs. 2,000, depending on the DP. Reviewing the annual fee ensures clarity on recurring costs.

Demat Charges

Holders of physical share certificates need to convert them into electronic form. The brokerage charges a dematerialisation fee for this conversion. Understanding this charge is important for those transitioning from physical holdings.

Technology Platform

The trading platform's quality significantly impacts the trading experience. A reliable platform ensures uninterrupted access during market hours. Evaluating platform reliability and features helps in making an informed choice.

Customer Support

Reliable customer support through phone, email, or chat is essential, particularly during trading hours. Checking the availability and responsiveness of support services ensures assistance when needed.

Research and Advisory

Full-service brokers provide investment research, stock recommendations, and market insights. These additional services may aid informed decision-making.

Ease of Fund Transfer

Hassle-free fund transfer between the bank account and trading account enhances convenience. Efficient transfer mechanisms ensure quick access to funds for trading activities. Evaluating transfer options improves operational efficiency.

Account Opening Process

A fully online and paperless process using e-KYC enables quick and efficient account opening. Digital processes reduce documentation requirements and accelerate account activation. Checking the simplicity of the opening process ensures a smooth start.

Conclusion

Demat charges form an important part for anyone starting their investing journey. They include account opening fees, maintenance costs, transaction charges, and other service-related expenses. These charges differ across DPs and depend on the account type, transaction volume, and value of holdings. Understanding these fees could help individuals manage Demat account opening related costs and also choose a suitable service provider. More details regarding the charges of a Demat account are available on the website of BlinkX, or can also be accessed easily through an online trading app on mobile devices.

- BlinkX launches ItsATraderThing Campaign

- blinkX Introduces 'Options Watchlist' to Empower Traders with Real-Time Insights

- BlinkX Enhances Trading with 24/7 Customer Support Capabilities

- Unlocking Seamless Trading: Introducing “Order Slicing” For The FnO Market

- A Game-Changer for Traders: Introducing Horizontal Watchlists

FAQs on Demat Account Charges

What is brokerage on a Demat account?

Brokerage on a Demat account refers to the charges one needs to pay on behalf of their trade, the maintenance of the Demat account, or the opening charges of the Demat Account.

Are there any hidden charges in a Demat Account?

No, there are no hidden charges on your Demat account. You can check all Demat account-related charges on BlinkX.

What is the minimum balance you need to keep for a Demat Account?

Demat account does not require a minimum balance. Investors can keep any number of shares, just like a zero-balance account, or can keep their Demat account empty.

What happens if you don't pay your AMC for a Demat account?

Multiple reminders will be sent to the individuals registered email ID or mobile number if they fail to pay AMC. Failing to pay AMC might freeze Demat accounts.

Will the Demat account charges change over time?

Demat account charges may change over time depending on broker’s policy, government new policy, account type and holding value.